Navigating the Shifting Sands: Selling Your Home with a Contingency in a Softening Seller's Market

Navigating the Shifting Sands: Selling Your Home with a Contingency in a Softening Seller's Market

For many homeowners looking to make a move, the ideal scenario is a seamless transition from one property to the next. In a robust seller's market like the one we have been in (and still are, to some extent), this often meant listing your home and expecting multiple strong offers with few demands. However, as the market begins to soften, sellers face new considerations, particularly when they need to sell their current home to finance the purchase of their next. Placing your home on the market with a contingency to buy another can be a strategic move, but it requires careful planning and the right protective measures.

Understanding the Shifting Landscape

While the market may still technically favor sellers, the leverage is slowly but surely shifting towards buyers. This means buyers are becoming more discerning, less willing to waive contingencies, and more inclined to negotiate. Properties are taking slightly longer to sell, and price reductions are becoming more common in some areas. For sellers, this necessitates a more nuanced approach to pricing, presentation, and contract negotiations.

The Contingency to Buy: A Seller's Perspective

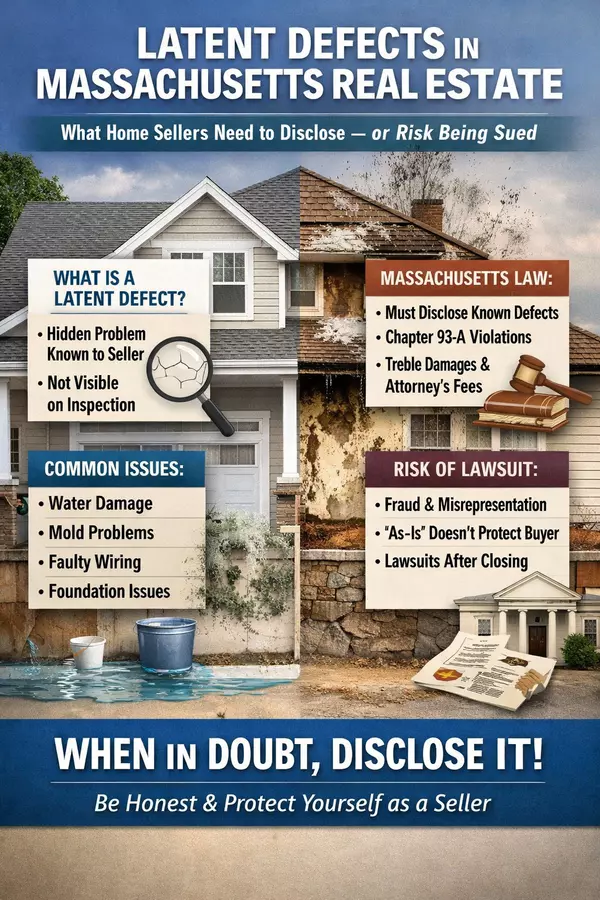

A "contingency to buy another home" clause in your listing and sale agreement means that the sale of your current property is dependent on you successfully finding and securing a new home. This provides crucial peace of mind, preventing you from being without a place to live or facing the financial burden of carrying two mortgages.

However, in a softening market, this contingency can make your home less attractive to potential buyers who prefer a swift, straightforward transaction. To counter this, it's essential to implement strategies that both appeal to buyers and protect your interests.

Strategies for Success in a Softening Market:

-

Price Strategically from Day One: Overpricing in a softening market is a common pitfall. Homes that sit on the market for too long often become stale, leading to multiple price drops and a lower eventual sale price. Price your home competitively, perhaps even slightly below comparable recently sold properties, to generate immediate interest and potentially multiple offers. This can create a sense of urgency that might still lead to a bidding war, even in a softening market.

-

Impeccable Presentation is Non-Negotiable: First impressions are paramount. Invest in professional staging, high-quality photography, and potentially virtual tours. Declutter, depersonalize, and ensure every corner of your home is sparkling clean and well-maintained. Focus on curb appeal – a well-manicured lawn, fresh paint on the front door, and inviting landscaping can significantly impact a buyer's initial perception. In a market where buyers have more options, a move-in ready home stands out.

-

Flexibility and Communication: Be prepared to be flexible with showings and potentially offer a slightly extended closing period to accommodate your home search. Open and honest communication with potential buyers, through your agent, about your need for a contingency can also build trust and understanding. A buyer will typically only give you a certain amount of time to get a new home under contract, typical 6-8 weeks. In a limited inventory real estate market, it might be difficult to find exactly what you are looking for in that time period.

Other Things to Consider:

- "Kick-Out Clause" (Right of First Refusal): If you put a new home under contract before selling your current home, it's likely that a Seller will want what is known as a Kick-out Clause included. This means that the Seller can continue to market the property and if they receive a stronger, non-contingent offer, they will then give you a specified timeframe (e.g., 24, 48, or 72 hours) to remove your home sale contingency and proceed with the purchase, or you can back out of the sale.

-

Sell Before You Buy: In a real estate market where the number of homes for sale is limited (like the current summer 2025 market on the North Shore of Massachusetts), it can be hard to find the perfect home. The best plan of action is to sell your home first, and then do a short-term rental. This will take the pressure off of trying to secure a new home in the limited time you have, and allow you to find the home that suits you best. You don't want to be pressured into buying a home that you will later regret.

- Buy Before You Sell: Providing you have enough equity in your home, and you qualify for it, consider doing a Bridge Loan. A bridge loan provides you with the funds to buy your new home before you sell your current one. Bridge loans usually have mimimal payments (interest only) until you sell your current one, at which time you can refinance into a new loan adding the funds from the sale of your current home. There are some costs to doing this, but, again, it takes the pressure off of you.

Selling your home with a contingency to buy another in a softening seller's market requires a strategic mindset. By presenting your home in its best light, pricing it competitively, and including robust protective contingencies, you can navigate this transition effectively and achieve the highest possible price for your current property, while securing your next dream home.

Jim Armstrong

Armstrong Field Group

Aluxety Real Estate

978-394-6736

Categories

- All Blogs (102)

- Beverly, MA (5)

- Buying a Home (44)

- Condos For Sale (3)

- Danvers, MA (1)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (12)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (7)

- Selling a home (50)

Recent Posts