What are Massachusetts Homeowners REAL Options in 2026?

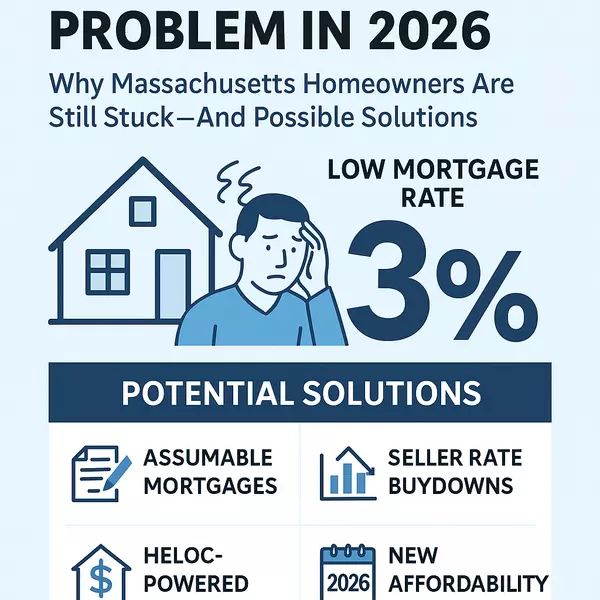

The 3% Mortgage Problem: Why So Many Massachusetts Homeowners Are Still Stuck—And What Their Real Options Are in 2026 By Jim Armstrong • ALUXETY Real Estate & Armstrong Field Group If you’re a homeowner on the North Shore or anywhere in Massachusetts, chances are you’re still holding onto a 2–3% m

Read MoreWhat Are Portable Mortgages—and Could They Boost Housing Inventory in the U.S.?

What Are Portable Mortgages—and Could They Boost Housing Inventory in the U.S.? In today’s real estate market, millions of American homeowners feel “locked in” by historically low interest rates. With mortgage rates now far higher than the 2–3% loans many secured between 2020 and 2022, even families

Read MoreFinancing Options for Home Buyers

Purchasing a home is one of the most significant financial decisions many people will make. Understanding the various Massachusetts home financing options can help buyers select the loan program that best fits their budget, credit profile, and long-term goals. Below is an overview of the most common

Read More6 Myths About Mortgages That May Keep You From Buying a Home

Home-Buying Myths That Could Be Holding You Back Thinking you’re not ready to buy a home yet? Many renters assume the financial barriers are too high, but much of what people believe about mortgages simply isn’t true. Let’s clear up some of the most common myths so you can feel more confident abou

Read More

Categories

Recent Posts