What Is Going to Happen with the Housing Market in 2026? (North Shore, Massachusetts)

If you’ve been watching the North Shore market—Beverly, Salem, Danvers, Peabody, Marblehead, Gloucester, and friends—you’ve seen a stubborn mix of low inventory, sticky prices, and buyers waiting for rates to break meaningfully lower. 2026 won’t be a “back to 3% mortgages” year, but the tea leaves point to a busier market with moderating rates, slightly better inventory, and still-firm prices—especially for move-in-ready single-families near transit and the coast.

The Big Real Estate Market Drivers to Watch

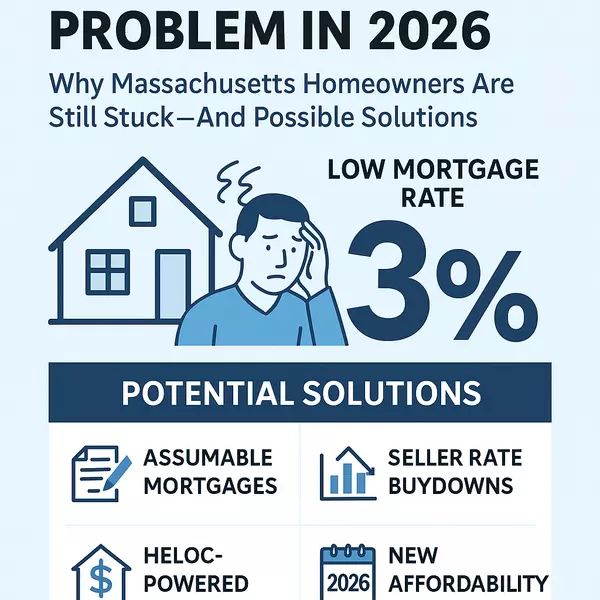

1) Mortgage rates: easing, not crashing

Multiple forecasters see 30-year rates hovering in the mid-6s for much of 2026, with the possibility of dipping closer to the high-5s by late year if inflation cooperates. Fannie Mae’s September outlook pegs ~5.9% by end-2026, while the Mortgage Bankers Association expects ~6.0–6.5% on average; NAR’s economists place the “sweet spot” for demand around 6%. Translation: affordability improves a bit, but the lock-in effect doesn’t disappear.

2) Sales volume: a rebound from the bottom

With rates edging down and more would-be movers unsticking, 2026 home sales are projected to rise nationally (low double-digit increases in some forecasts). That won’t feel like 2021, but it should feel busier than 2024–2025.

3) Prices: Boston-area still firm

Greater Boston price indices were running ~4% year-over-year into late summer 2025, reflecting chronic undersupply. Expect flat-to-modest appreciation in 2026 on the North Shore, with premium locations (walkable, renovated, water-adjacent but not high-risk) staying competitive.

North Shore-Specific Factors

North Shore-Specific Factors

Inventory: signs of life, but still tight

North Shore REALTORS® reported year-over-year inventory growth in mid-2025 (condo supply popped even as condo medians softened slightly). Months of supply remains lean, but the trend toward “a bit more to choose from” could continue into 2026, especially for condos and townhomes.

Policy tailwinds that add gradual supply

- MBTA Communities (3A) compliance: Most commuter-rail communities had deadlines by late 2024/2025; the SJC upheld the law in January 2025. As new by-right multifamily districts get implemented near stations (Salem, Beverly, Lynn, etc.), expect incremental infill over several years—not an overnight surge, but it helps.

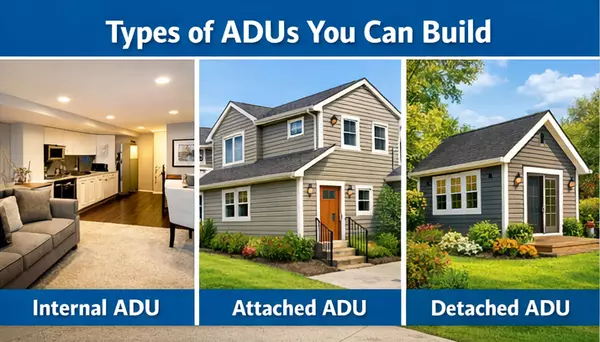

- ADUs legalized statewide: As of 2025, ADUs up to 900 sq. ft. are allowed by right in single-family zones; applications surged in the first half of 2025. That supports gentle density, multigenerational living, and some rental flexibility—again, a slow-burn supply booster for 2026+.

Coastal risk & insurance: a growing line item

Rising premiums and stricter underwriting—especially in flood-exposed pockets—are part of the 2026 cost picture. Buyers should underwrite insurance early, price in flood-map updates, and weigh elevation/mitigation. Expect insurers to stay cautious, even as availability varies town by town.

What This Likely Means by Segment

- Move-in-ready single-families (Beverly, Salem, Peabody, Danvers): Still multiple-offer candidates if priced right; modest price gains possible in 2026 as demand improves. Walkable neighborhoods near commuter rail remain hot.

- Condos & townhomes (Salem, Lynn, Peabody): Inventory has been improving; expect more balanced conditions and greater negotiation room than in 2023–2024—good entry points for first-time buyers.

- Coastal & second-home niches (Marblehead, Manchester-by-the-Sea, Rockport, Gloucester): Lifestyle demand stays resilient; insurance and flood-risk diligence are decisive to total cost and resale value.

- Small multi-family: Investor calculus hinges on rates vs. rents vs. rehab/insurance costs. Slightly lower rates may revive activity; ADUs create accessory rental options for owners.

Buyer Playbook for 2026

- Get rate-ready: Lock-and-shop with float-down options; structure 2-1 buydowns when appropriate. Forecasts see mid-6s prevailing with dips—use them.

- Price the total monthly: Include HOA/condo fees, insurance (esp. flood), and utilities; premiums are a swing factor in coastal towns.

- Be flexible on property type/finish: Condos/townhomes and homes needing light updates may offer value as single-family cream puffs draw crowds.

Seller Playbook for 2026

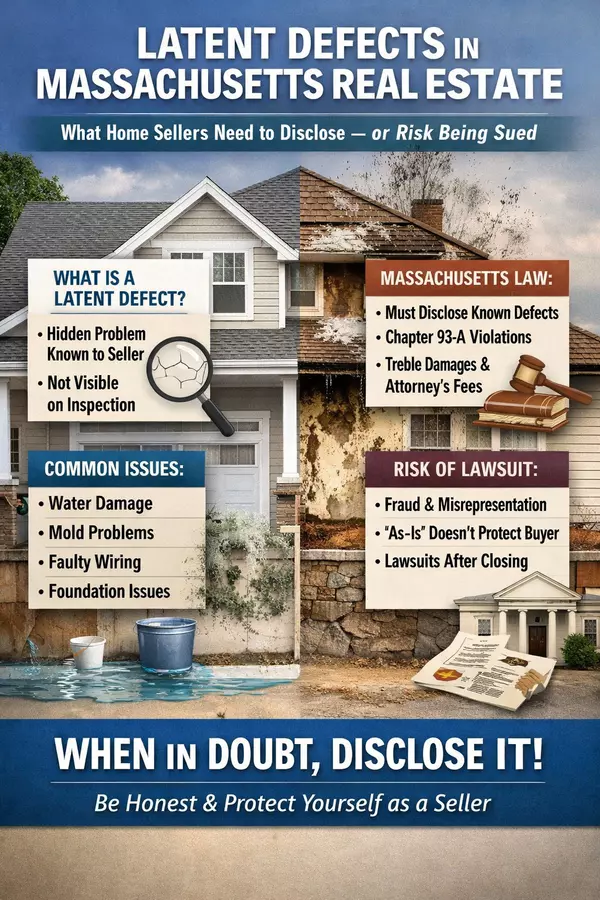

- List smart, not just high: With a little more inventory, first-impression pricing and presentation matter.

- Fix the “no”s: Pre-list inspections, small repairs, and energy/insurance documentation help keep buyers confident and deals together.

- Time the market vs. your life: Spring still brings the widest audience, but serious buyers shop year-round—especially near commuter rail and good school zones.

Our Bottom Line for the North Shore in 2026

- Rates: Easing toward ~6% late-year is plausible; plan for mid-6s as the working number.

- Sales: Up from the trough; showing activity and accepted offers should improve.

- Prices: Flat to modestly higher overall; best-located, updated homes hold an edge.

- Supply: Gradual lift from ADUs and MBTA-zoned sites, more noticeable in condos/townhomes than single-family.

- Costs: Insurance remains a wild card on/near the water—budget early.

Thinking about a 2026 move on the North Shore? I can send you a micro-market snapshot (price trends, months of supply, and on-market picks) for your target neighborhood and budget—plus lender introductions to model different rate/point scenarios.

Jim Armstrong

North Shore Massachusetts REALTOR/Broker

jarmstrong@armstrongfield.com

Mobile talk/text 978-394-6736

Categories

- All Blogs (97)

- Beverly, MA (4)

- Buying a Home (40)

- Condos For Sale (3)

- Home Ownership (27)

- Homes For Sale (7)

- Living on the North SHore (10)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (19)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (48)

Recent Posts