What Are Portable Mortgages—and Could They Boost Housing Inventory in the U.S.?

What Are Portable Mortgages—and Could They Boost Housing Inventory in the U.S.?

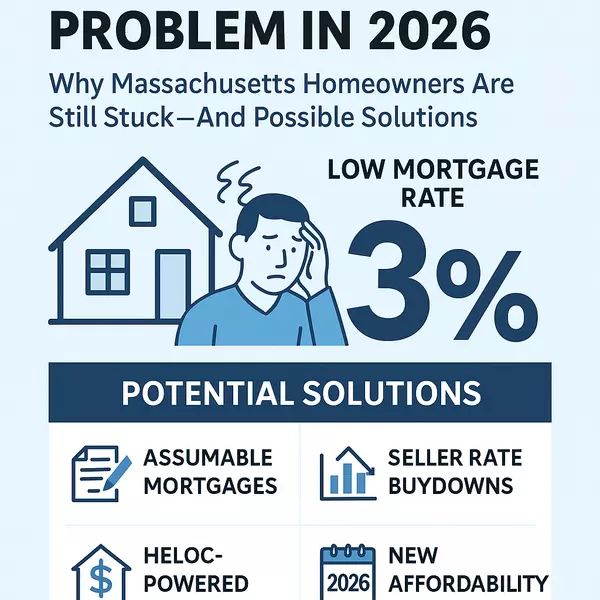

In today’s real estate market, millions of American homeowners feel “locked in” by historically low interest rates. With mortgage rates now far higher than the 2–3% loans many secured between 2020 and 2022, even families who want to move often hesitate—because buying a new home means giving up their ultra-low rate.

But what if you could take your mortgage with you?

That’s the idea behind portable mortgages, a feature widely available in other countries—and one that could make a major difference in U.S. housing inventory if it were introduced here.

What Is a Portable Mortgage?

A portable mortgage is a home loan that allows homeowners to transfer—or “port”—their existing mortgage, including its interest rate and terms, to a new property when they move.

Instead of applying for an entirely new mortgage at current rates, a borrower keeps their original loan and attaches it to their next home (often with adjustments for price differences).

Portable mortgages are commonly available in countries like:

- Canada

- United Kingdom

- Australia

- New Zealand

- Ireland

In these markets, portability is a standard feature that helps maintain consumer mobility and stabilizes housing supply.

Why Don’t We Have Portable Mortgages in the U.S.?

Most U.S. mortgages are securitized through Fannie Mae and Freddie Mac, then sold on the secondary market. Because of the structure of mortgage-backed securities, transferring an existing loan to a new property would require new regulations, new loan products, and new servicing standards.

But the idea is gaining traction as policymakers look for ways to combat the national shortage of housing inventory.

Advantages of Portable Mortgages

1. Homeowners Can Keep Their Low Interest Rate

This is the biggest appeal. If you currently have a 3% mortgage, portability would let you keep that rate—even if the market is sitting at 7%.

2. Encourages Homeowners to Move

Many Americans feel financially trapped. Portability could free up:

- Empty nesters ready to downsize

- Families needing more space

- Homeowners relocating for work

All without suffering the “payment shock” of today’s higher rates.

3. Could Increase Housing Inventory

More people would be willing to sell if they could bring their mortgage with them.

This could:

- Ease the inventory shortage

- Reduce bidding wars

- Stabilize prices in overheated markets

4. Could Make the Market More Balanced

Portability improves turnover, helping match buyers and sellers more efficiently—something currently lacking in many U.S. markets.

Disadvantages of Portable Mortgages

1. They’re More Complex

The lender must reassess the borrower and the new property. In many countries, the loan becomes a blend of old and new terms if additional funds are needed.

2. Portability Usually Has a Time Limit

For example, in Canada, borrowers typically have 30–120 days to port their mortgage while selling and buying.

3. Not Ideal for Major Upsizing

If your next home costs significantly more, you may need:

- A “blended” rate

- A secondary loan

- A refinance of part of the mortgage

4. May Not Work for All Loan Types

Not all mortgages—even abroad—are portable. Certain adjustable-rate or specialized loans may be excluded.

Why Portable Mortgages Could Change Everything in the U.S.

Right now, more than 80% of American homeowners with a mortgage have a rate under 5%, and nearly two-thirds are below 4%. Many would move if they didn’t have to trade their 3% rate for a 7% one.

If the U.S. adopted portable mortgages:

- More homeowners would list their homes

- More inventory would hit the market

- Buyers would have more options

- Sellers could move without financial strain

- The market could return to healthier transaction levels

Portable mortgages won’t solve all inventory problems, but they could be a powerful lever to unlock supply.

Final Thoughts

Portable mortgages are a proven tool in other countries, helping homeowners stay mobile and markets stay active. Introducing them in the U.S. could be a game-changer—especially for people stuck holding onto their homes solely because they don’t want to lose a historically low interest rate.

If you're considering selling your Massachusetts home but you’re worried about your current mortgage rate, let’s talk. I can walk you through your options, market conditions, and strategies to make your next move financially worthwhile—even without portability (for now).

Categories

- All Blogs (99)

- Beverly, MA (4)

- Buying a Home (42)

- Condos For Sale (3)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (11)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (49)

Recent Posts