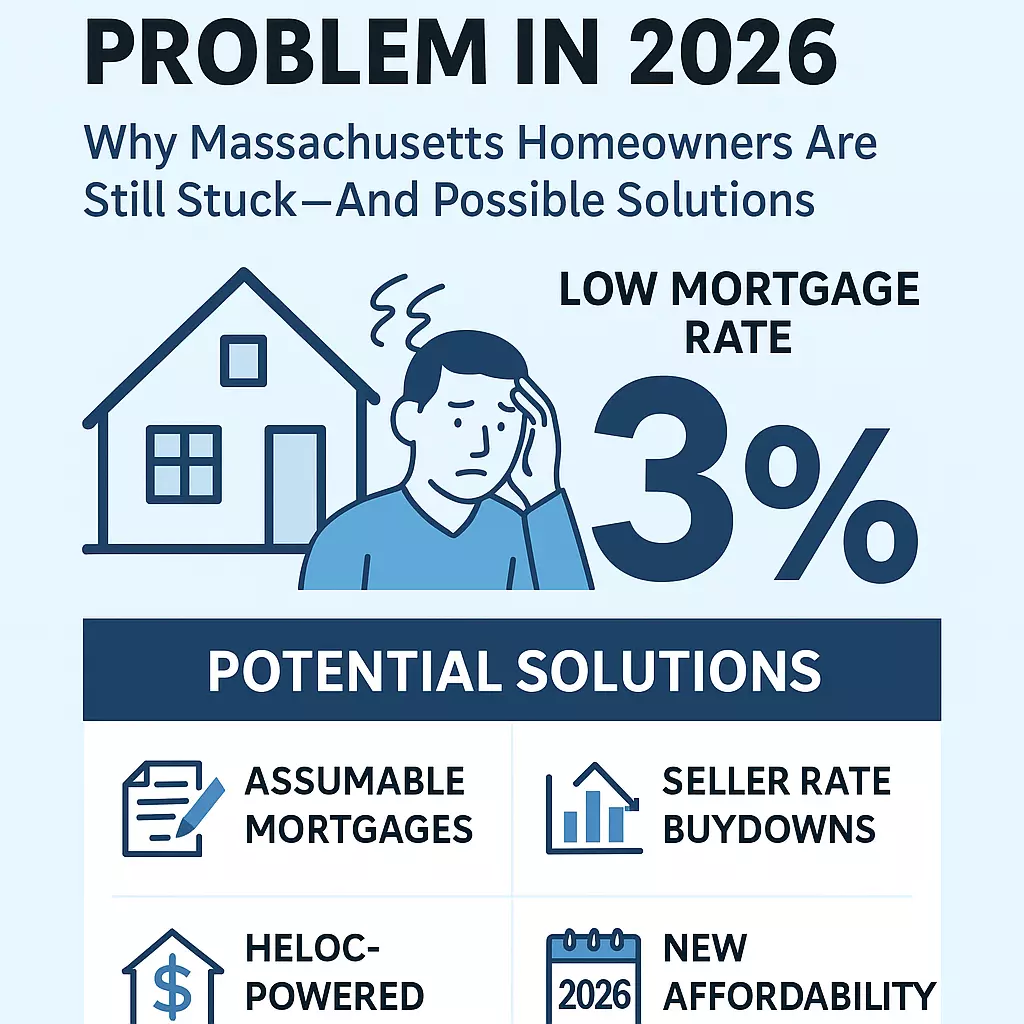

What are Massachusetts Homeowners REAL Options in 2026?

The 3% Mortgage Problem: Why So Many Massachusetts Homeowners Are Still Stuck—And What Their Real Options Are in 2026

By Jim Armstrong • ALUXETY Real Estate & Armstrong Field Group

If you’re a homeowner on the North Shore or anywhere in Massachusetts, chances are you’re still holding onto a 2–3% mortgage rate—and still wondering whether moving in 2026 finally makes financial sense. You’re not alone; more than 70% of Massachusetts homeowners still have a rate under 4%.

This “mortgage lock-in effect” has shaped the entire real estate market for the past four years. It’s the primary reason housing inventory across the North Shore—Salem, Beverly, Danvers, Peabody, Lynn, Marblehead, and surrounding communities—has remained at some of the lowest levels ever recorded.

But here’s the part that most homeowners don’t know:

2026 may actually be the turning point.

New lending tools, emerging policy discussions, and shifting buyer incentives may finally make it possible to move without throwing away your historically low rate.

Let’s break down what’s changing—and what your real options are.

What Exactly Is the 3% Mortgage Problem?

Between 2020 and 2022, millions of homeowners refinanced into incredibly low mortgage rates. Some locked in rates as low as 2.25%.

Fast-forward to today:

Rates have stayed in the 5.75%–7% range, despite predictions they would drop more significantly.

That leaves homeowners saying:

“Why would I trade my 3% mortgage for a 6% mortgage?”

This is the lock-in effect—and it’s why so few Massachusetts homes have hit the market these past few years.

How the 3% Mortgage Problem Impacts the North Shore in 2026

Even as interest rates slowly ease, the effects are still visible:

✔️ Low inventory persists

Neighborhoods that normally see steady turnover—like Beverly’s Ryal Side, Salem’s Witchcraft Heights, and Danvers Highlands—are still seeing fewer listings than normal.

✔️ Prices remain high

Buyers continue to compete for limited inventory, keeping prices stable or rising despite high borrowing costs.

✔️ Buyers are using more creative financing

Assumptions, buydowns, and bridge loans are becoming increasingly common.

✔️ Sellers still underestimate their leverage

Well-priced homes on the North Shore still sell quickly, even in a higher rate environment, because demand remains strong.

The Good News: You Have More Options Than You Think in 2026

1. Assumable Mortgages (A massive opportunity for sellers)

FHA and VA loans allow buyers to assume your existing low rate.

This can make your home far more attractive than competing properties.

Example:

Your loan: $395,000 at 2.75%

Buyer assumes it and only finances the remainder.

Homes offering assumable mortgages get more showing requests, more offers, and stronger buyer interest.

2. Portable Mortgages (A policy gaining traction)

While the U.S. still hasn’t formally adopted wide-scale mortgage portability like Canada and the UK, 2026 is seeing renewed discussion among lawmakers and lenders.

Early signs include:

-

Fannie/Freddie exploring transferability models

-

pilot programs for rate-preserving refis

-

renewed political interest in affordability reforms

Even partial portability could unlock thousands of Massachusetts homes.

3. Seller-Paid Rate Buydowns (A powerful tool in 2026)

Rate buydowns remain one of the most effective strategies for sellers:

-

1-0 buydown

-

2-1 buydown

-

3-year step-downs

-

permanent buydowns

Instead of dropping your price $20,000, a buydown costing far less can give the buyer a temporary or permanent lower rate, making your home much more affordable.

4. Keep Your 3% Mortgage & Use a HELOC to Buy Your Next Home

A popular option in 2026:

-

Use a HELOC (Home Equity Line of Credit) to fund your next home’s down payment.

-

Keep your 2–3% mortgage intact.

-

Move.

-

Sell your current home later and pay off the HELOC.

This approach helps buyers who aren’t ready to give up their low fixed rate but still need to move.

5. Rent Out Your Current Home at a Profit

With your low mortgage rate, renting out your home can create strong cash flow—especially in high-demand areas like:

-

Salem

-

Beverly

-

Peabody

-

Lynn

-

Marblehead

-

Danvers

-

Swampscott

Your low-rate payment gives you a huge financial advantage if you choose to rent instead of sell.

Will More Homes Hit the Market in 2026?

Most industry analysts believe inventory will rise modestly in 2026 as:

-

rates gradually trend downward

-

life events force movement despite rate differences

-

new loan products and incentives ease affordability challenges

If mortgage rates dip into the mid-5% range, we could see a meaningful jump in listings across the North Shore.

Even a small rate improvement can be enough to break the logjam.

So… Should You Make a Move in 2026, or Keep Waiting?

Here’s the truth: Life—not interest rates—drives most moves.

People move because they need:

-

more space

-

less space

-

a new location

-

a different lifestyle

-

proximity to family

-

a change in monthly expenses

-

a new job

-

better schools

-

lower maintenance

If your life is pointing toward change, let me help you explore the options that let you move without losing everything you love about your current mortgage.

You may have more choices than you realize.

Considering a Move in 2026? Let’s Explore Your Options Together

As a 25-year North Shore Realtor® and broker, I can help you evaluate:

-

Whether your loan is assumable

-

Whether your home could cash flow as a rental

-

Whether a HELOC makes sense

-

How buydowns could attract strong buyers

-

What your home is worth today

-

Whether it’s smarter to move now or wait until conditions shift further

👉 Get a free, updated home value report: https://armstrongfield.com/evaluation

👉 Schedule a no-pressure consultation: https://armstrongfield.com/contact

👉 Search all North Shore homes for sale: https://armstrongfield.com/listing

You don’t need to navigate this alone—there are solutions that let you move forward without giving up your financial advantage

Jim Armstrong

Armstrong Field Group

Aluxety Real Estate

Categories

- All Blogs (102)

- Beverly, MA (5)

- Buying a Home (44)

- Condos For Sale (3)

- Danvers, MA (1)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (12)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (7)

- Selling a home (50)

Recent Posts