Why Waiting for Mortgage Rates to Drop Could Cost You More Than You Think

Why Waiting for Mortgage Rates to Drop Could Cost You More Than You Think

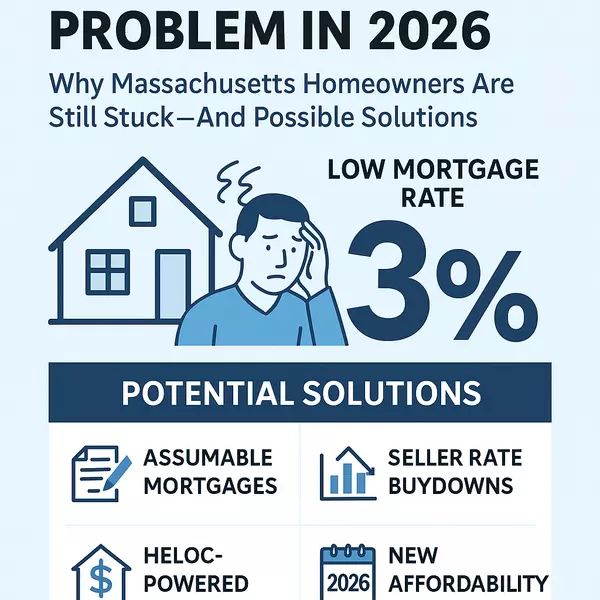

It’s tempting to think, “I’ll just wait until mortgage rates go down before I buy a home.” On the surface, it seems logical — who wouldn’t want a lower monthly payment? But when you dig deeper, waiting for that perfect rate could actually hurt you in the long run, especially in a market like Massachusetts’ North Shore where home prices are steadily rising.

Let’s look at a simple example.

The Waiting Game: 0.25% Lower Rate vs. 3% Higher Home Price

The Waiting Game: 0.25% Lower Rate vs. 3% Higher Home Price

Imagine you’re considering buying a $700,000 home today at a 6.5% interest rate with 10% down. Your monthly principal and interest payment would be roughly $3982.

Now let’s say you decide to wait one year, hoping rates will fall by 0.25% — to 6.25%. Great news, right? Not necessarily.

During that same year, if home prices rise by a modest 3%, that $700,000 home now costs $721,000. With 10% down, your loan amount becomes higher — and even with the lower interest rate, your new monthly payment ends up around $3995.

You waited an entire year, hoping to save, but you actually end up paying slightly more — and that’s before factoring in:

-

Higher property taxes and insurance based on the new home value

-

Lost equity growth you would have built during that year

-

Potential competition if rates drop and more buyers flood the market

The Real Cost of Waiting

While 0.25% might sound significant, home price appreciation often outpaces the benefit of a small rate drop. Even if prices rise just 2–3% annually (which is conservative for much of Essex County and the North Shore), your purchasing power declines faster than rates tend to improve.

Plus, you can always refinance later if rates fall — but you can’t go back in time and buy at today’s prices.

Bottom Line

Waiting for rates to drop can feel like playing it safe, but in most cases, the math shows that time in the market beats timing the market. If you find the right home and it fits your budget, buying now could save you thousands over the long run.

If you’d like to see what buying today looks like for your specific situation — or how much you might lose by waiting — reach out to Jim Armstrong and The Armstrong Field Group at ALUXETY Real Estate for a personalized affordability and equity analysis.

👉 Request your free home buying strategy session

Jim Armstrong

Armstrong Field Group @ Aluxety

978-394-6736

Jarmstrong@armstrongfield.com

Would you like me to create a social media caption and SEO meta tags for this post too (for your blog and Facebook/Instagram sharing)?

Categories

- All Blogs (97)

- Beverly, MA (4)

- Buying a Home (40)

- Condos For Sale (3)

- Home Ownership (27)

- Homes For Sale (7)

- Living on the North SHore (10)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (19)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (48)

Recent Posts