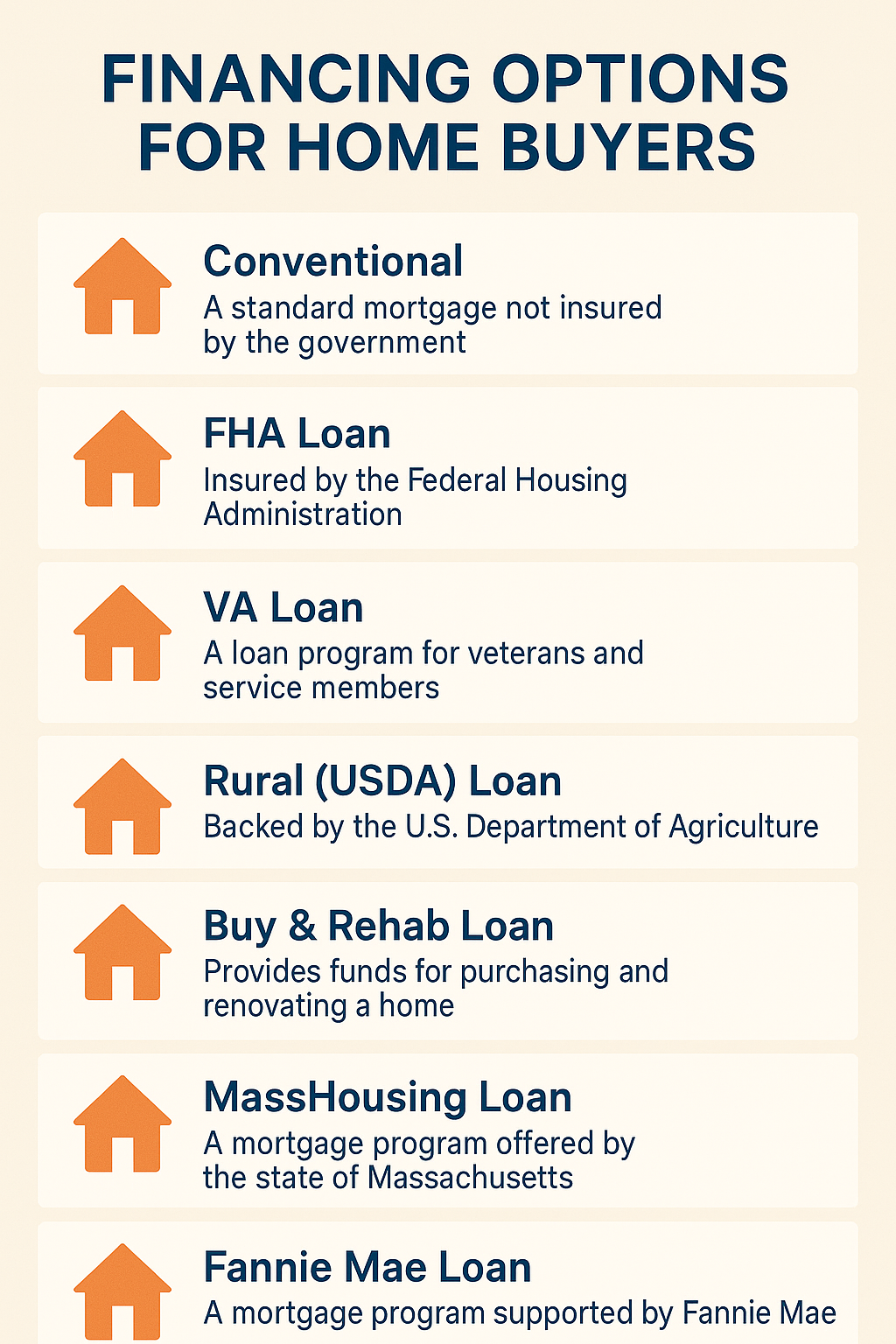

Financing Options for Home Buyers

Purchasing a home is one of the most significant financial decisions many people will make. Understanding the various Massachusetts home financing options can help buyers select the loan program that best fits their budget, credit profile, and long-term goals. Below is an overview of the most common mortgage programs available to home buyers.

1. Conventional Loans

Conventional loans are mortgage products that are not backed by any government agency. They are offered by private lenders such as banks, credit unions, and mortgage companies.

-

Down Payment: Typically requires a minimum of 3%–5% down, although putting 20% down avoids private mortgage insurance (PMI).

-

Credit Requirements: Generally, a higher credit score (usually 620 or above) is needed for approval and to secure competitive interest rates.

-

Best For: Borrowers with strong credit profiles and stable income who want flexible terms and potentially lower long-term costs.

2. FHA Loans

The Federal Housing Administration (FHA) insures FHA loans, making them a popular choice for first-time buyers or those with less-than-perfect credit.

-

Down Payment: As low as 3.5% with a credit score of 580 or higher.

-

Credit Flexibility: More lenient credit requirements compared to conventional loans.

-

Mortgage Insurance: Requires upfront and annual mortgage insurance premiums (MIP), which remain for the life of the loan unless refinanced.

-

Best For: Buyers with modest savings or lower credit scores who need a more accessible path to homeownership.

3. VA Loans

VA loans are guaranteed by the U.S. Department of Veterans Affairs and are available to eligible veterans, active-duty service members, and certain surviving spouses.

-

Down Payment: No down payment required.

-

Mortgage Insurance: No private mortgage insurance (PMI), which helps reduce monthly costs.

-

Benefits: Competitive interest rates and limited closing costs.

-

Best For: Veterans and service members seeking one of the most cost-effective home financing options.

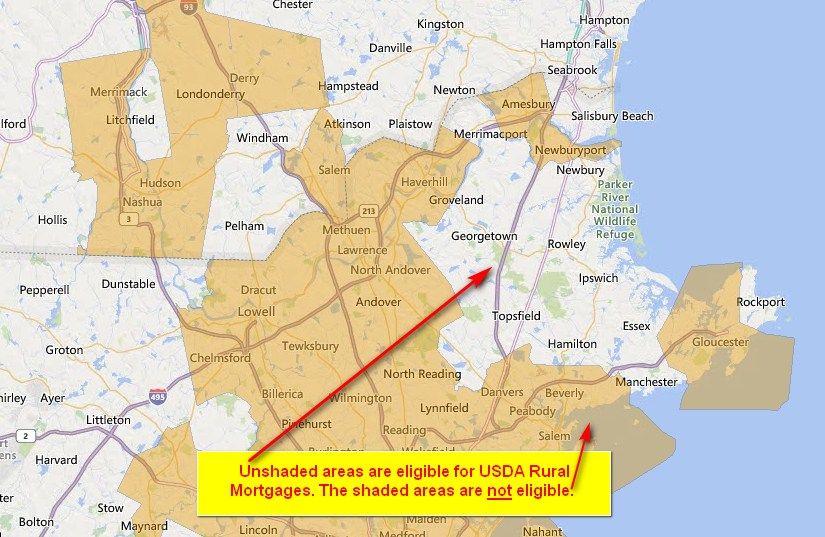

4. Rural (USDA) Loans

Backed by the U.S. Department of Agriculture (USDA), rural development loans aim to encourage homeownership in eligible rural and suburban areas.

-

Down Payment: No down payment required.

-

Eligibility: Must meet income limits and the property must be in a designated rural area.

-

Mortgage Insurance: Requires a guarantee fee, which can be financed into the loan.

-

Best For: Buyers looking for homes in rural or semi-rural communities with limited cash for a down payment.

5. Buy & Rehab Loans

The Buy & Rehab loan is designed for buyers purchasing a fixer-upper and needing funds to renovate.

-

Purpose: Combines the cost of the home purchase and renovation into a single mortgage.

-

Down Payment: As low as 3.5%.

-

Types:

-

FHA 203K Buy & Rehab Loan

-

Standard 203(k) for major repairs and structural improvements.

-

Limited 203(k) for smaller, non-structural upgrades.

-

- Private Lender Purchase & Rehab Loans. Many banks have their own mortgage products for Buying and rehabbing a home.

-

-

Best For: Buyers willing to take on a property that requires significant repairs or modernization.

6. MassHousing Loans

MassHousing is a state-sponsored agency in Massachusetts that offers affordable mortgage programs to first-time and repeat home buyers.

-

Down Payment Assistance: Provides various programs with low or no down payment options and competitive rates.

-

Features: Fixed-rate loans, flexible underwriting, and down payment/closing cost assistance.

-

Best For: Massachusetts residents seeking affordable financing, particularly first-time buyers or moderate-income households.

7. Fannie Mae Loans

Fannie Mae, a government-sponsored enterprise (GSE), supports several mortgage products designed to increase homeownership opportunities.

-

HomeReady Program: Requires as little as 3% down and allows flexible income sources, including contributions from non-borrowing household members.

-

Standard Conventional: Offers competitive rates for buyers with strong credit.

-

Best For: Buyers with steady income who want low down payment options while benefiting from conventional loan advantages.

Choosing the Right Loan Program

The best financing option depends on your financial situation, homeownership goals, and eligibility criteria.

-

Strong Credit & Savings: Conventional or Fannie Mae loans may provide the best long-term savings.

-

First-Time Buyers or Lower Credit: FHA or MassHousing programs can offer a more accessible entry point.

-

Military Service: VA loans are often unmatched in terms of benefits.

-

Rural Buyers: USDA loans make homeownership possible with no down payment.

-

Fixer-Upper: FHA 203(k) loans allow financing for renovations.

Final Thoughts

Exploring multiple loan programs and comparing interest rates, fees, and terms is critical before making a decision. Working with a knowledgeable mortgage lender or housing counselor can help you evaluate these financing options and secure the loan that best supports your path to homeownership.

Categories

- All Blogs (102)

- Beverly, MA (5)

- Buying a Home (44)

- Condos For Sale (3)

- Danvers, MA (1)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (12)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (7)

- Selling a home (50)

Recent Posts