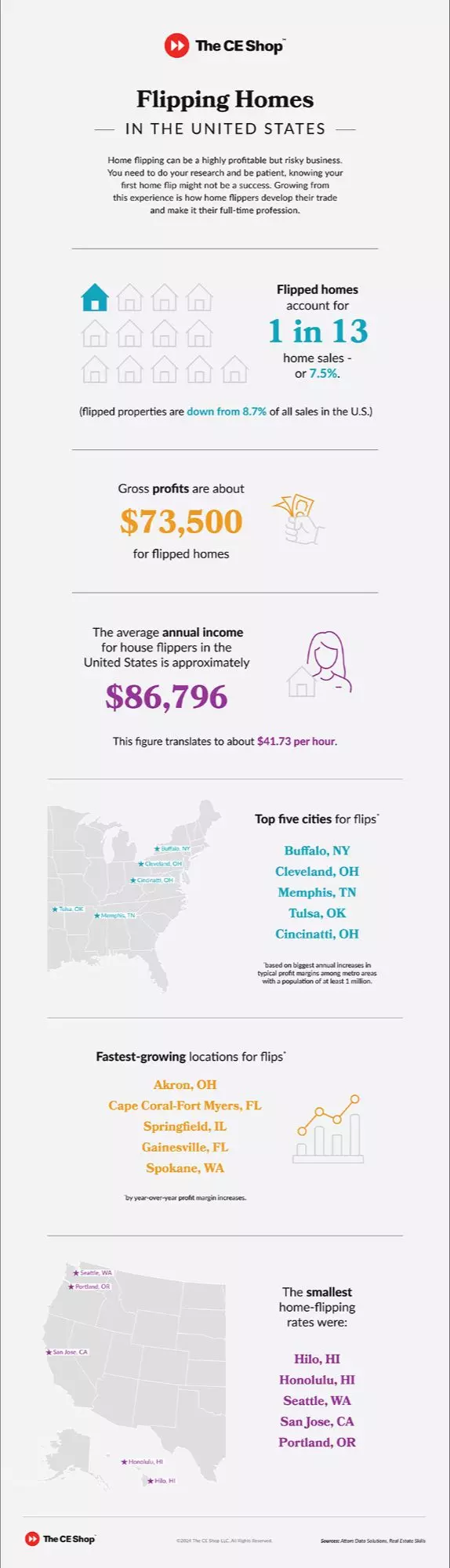

How Much Money Can You Make Flipping Houses?

There’s probably a good chance you’ve stumbled on one of the millions of home renovation shows or online videos and thought to yourself, “Heck, I can do that.” While the profitability of flipping homes can be bountiful, becoming an expert in this niche takes knowledge and experience. Today, we'll

Read MoreRenovated Two Family Home For Sale at 16 Horton Street, Salem, MA

Discover Multi-Generational Comfort at 16 Horton Street, Salem, MA If you’ve been searching for a home that brings everyone together without sacrificing space or privacy, 16 Horton Street in Salem, MA, is a rare find. This spacious multi-family property is tailor-made for multi-generational living,

Read MoreThinking of Buying an Older Home? Here Are Some Things to Keep in Mind

There's an undeniable charm to older homes. The intricate details, the mature landscaping, the sense of history within the walls – it's a romantic notion for many prospective homeowners. But beneath that charming facade, older homes often come with a unique set of considerations that differ signific

Read MoreA Fresh Look at Condos for Sale in Salem, MA: What Buyers Need to Know

A Fresh Look at Condos for Sale in Salem, MA: What Buyers Need to Know Salem, Massachusetts, is a city where history and modern living blend seamlessly. Known for its rich past and vibrant downtown, Salem has become a hot spot for those seeking the charm of New England with the convenience of city a

Read MoreTips for Home Buyers: Getting Your Offer Accepted

Securing your dream home can feel like a competitive sport, especially in a hot real estate market. So, how do you make sure your offer stands out from the rest and gets accepted? Here are some key tips for home buyers looking to give their offer the winning edge: Tips for Home Buyers: Getting Your

Read MoreEmbracing the Future: Why a Green Home Makes Perfect Sense

Embracing the Future:Why a Green Home Makes Perfect Sense In an era of increasing environmental awareness and fluctuating energy costs, the concept of a "green" home – designed for energy efficiency and sustainability – is no longer a niche trend but a smart, practical choice for homeowners. Opting

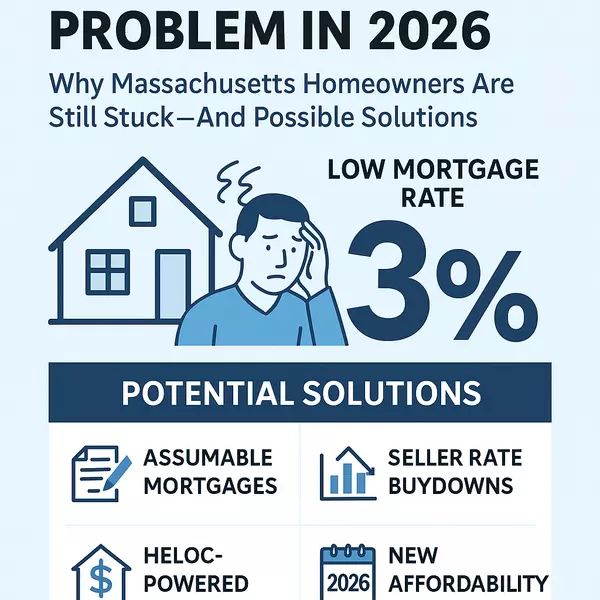

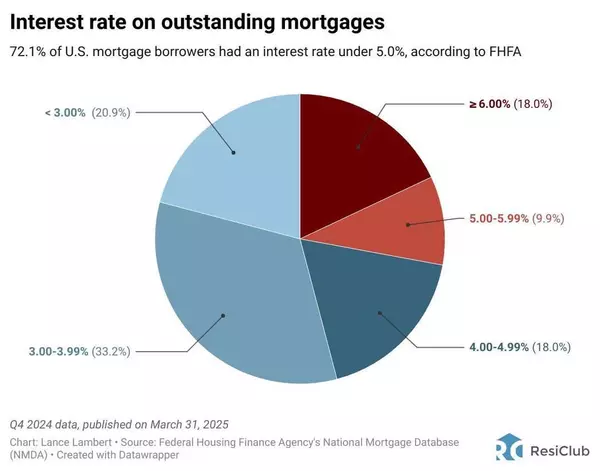

Read MoreInterest Rates on Outstanding Mortgages

Real Estate Market Update! Did you know that a significant majority – 72.1% – of U.S. mortgage borrowers are currently enjoying interest rates below 5.0%? That's according to the latest FHFA data from Q4 2024! Looking at the breakdown, a large portion has rates in the 3.00-3.99% (33.2%) and < 3.00%

Read MoreNavigating the Homebuying Journey: A Step-by-Step Guide

Navigating the Homebuying Journey: A Step-by-Step Guide to Your Dream Home Buying a home is a significant milestone, but it can also feel overwhelming. To demystify the process, here's a comprehensive guide outlining the essential steps to take: 1. Understand the Current Housing Market: The real est

Read MoreDecoding Home Values: Zillow, Redfin, RPR, and the Elusive "True" Market Value

When buying or selling a home, one of the first things you're likely to do is check its value on popular real estate websites like Zillow, Redfin, or Realtor Property Resource (RPR). These platforms offer Automated Valuation Models (AVMs), providing an estimate of a property's worth. But how accurat

Read MoreShould I Have a Home Inspection?

When you're in the market for a new home, the excitement of finding the perfect property can sometimes overshadow the practical steps necessary to ensure a sound investment. One critical step that often comes into question is whether to have a home inspection. While waiving a home inspection can mak

Read MoreDiscover Luxury Living at 106 Broadway, Salem: A Trio of Brand New Condominiums

$750,000 3 Beds | 2 Baths | 1,300 SqFt 106 Broadway, Salem, MA 01970-4555 Coming Soon Salem, Massachusetts, a city renowned for its rich history and vibrant cultural scene, is now home to a stunning new real estate opportunity. Located at 106 Broadway, three brand new luxury condominiums are availab

Read MoreBuying a home in Massachusetts

Buying a Home in Massachusetts Buying a home is an exciting and monumental step in anyone's life. Whether you're a first-time buyer or have bought multiple properties before, the process can be both thrilling and overwhelming. However, if you are considering buying a home in Massachusetts, there are

Read MoreReal Estate Insights - Monthly Newsletter

Here is a link to our latest copy of Real Estate Insights, the Armstrong Field Real Estate Newsletter. It contains some interesting facts about real estate, plus a new column called Jim's Journeys, about traveling to different places. What's that got to do with real estate? Absolutely nothing, but t

Read MoreCharming Cape-Style Home with Endless Potential in Hamilton, Massachusetts

$450,000 2 Beds | 1 Bath | 1,200 SqFt 16 Highland St, South Hamilton, MA 01982 Coming Soon Are you searching for a home with character and the potential to become your dream residence? Look no further than 16 Highland St, South Hamilton, MA 01982. With its quaint Cape-style architecture, this proper

Read MoreAre You Waiting for the Real Estate Market to Drop?

Have you been waiting for home prices to go down? I understand your concerns about the market, and it's natural to want to make a wise investment. However, it's worth considering that the real estate market has been quite resilient historically, and timing its fluctuations accurately is challengin

Read MoreGetting Your Offer Accepted with Multiple Offers

In today's competitive real estate market, it's not uncommon for homebuyers to find themselves in a bidding war with multiple offers on a property. So, how can you increase your chances of getting your offer accepted when faced with stiff competition? Here are a few strategies to consider: 1. Determ

Read MoreWhat do real estate agents do that they don't get paid for?

Real estate agents provide an array of services that help clients buy or sell properties. Their roles include conducting market research and analysis to determine the right price for the property. They also help promote the property and secure a favorable sale or purchase agreement. However, not all

Read MoreHow do I sell and buy a home at the same time?

Selling a home and buying a new one can be a daunting task, especially when you want to do both at the same time. There are many things to consider such as timing, financing, and making sure that everything goes smoothly. In this blog post, we will explore some tips on how to sell and buy a home at

Read More

Categories

Recent Posts