Should I Have a Home Inspection?

When you're in the market for a new home, the excitement of finding the perfect property can sometimes overshadow the practical steps necessary to ensure a sound investment. One critical step that often comes into question is whether to have a home inspection. While waiving a home inspection can make an offer more competitive, especially in a seller's market, it could cost you significantly in the long run.

For many buyers, the allure of skipping the home inspection lies in the potential to make their offer stand out. In hot real estate markets where multiple bids are common, sellers often look for offers with fewer contingencies. By waiving the inspection, you might edge out other buyers and secure your dream home. However, this decision isn't without risks.

A home inspection serves as a crucial safeguard for buyers. It provides an objective evaluation of the property's condition, identifying potential issues that may not be visible during a casual walkthrough. An inspector will thoroughly examine key components such as the roof, foundation, electrical systems, plumbing, and HVAC systems. This detailed assessment can reveal problems ranging from minor repairs to major structural deficiencies.

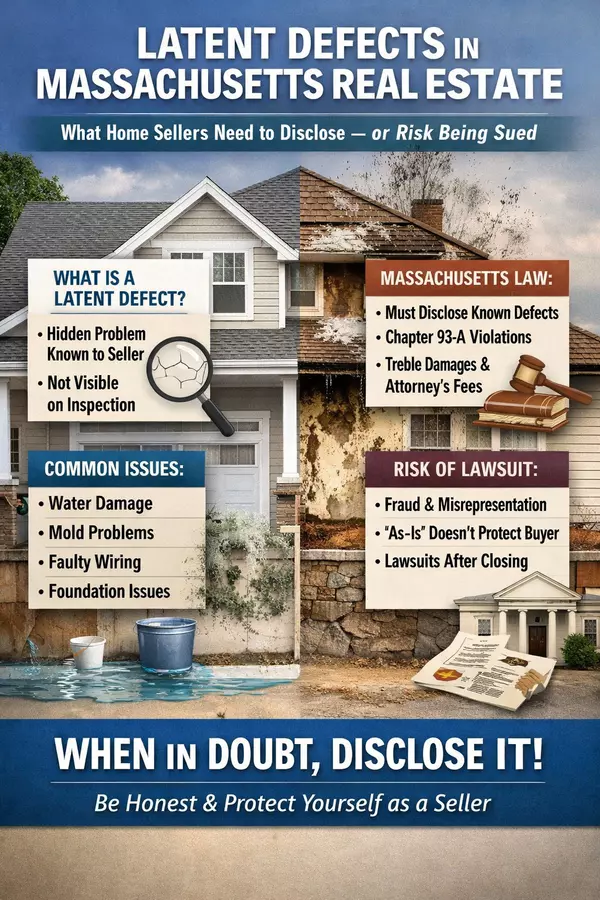

Without an inspection, you might unknowingly purchase a home with significant hidden defects. These issues can be costly to repair and may even impact your ability to live comfortably in your new space. For instance, discovering after closing that the roof needs replacing or that there are foundational cracks could lead to expenses running into tens of thousands of dollars. Such unforeseen costs can strain your finances and turn what seemed like a great deal into a financial burden.

Moreover, having an inspection report gives you leverage during negotiations. If the inspection uncovers problems, you can request that the seller address these issues before closing or adjust the sale price accordingly. This negotiation process can save you money and ensure that you're making a well-informed investment.

On the flip side, some buyers opt for pre-inspection before making an offer. This strategy involves conducting an inspection prior to submitting your bid, allowing you to waive the contingency confidently since you already know what you're getting into. While this approach requires an upfront cost for the inspection fee, it can provide peace of mind and strengthen your offer without sacrificing due diligence.

It's also worth noting that certain types of properties might necessitate specialized inspections beyond a standard one. For example, older homes may require additional checks for asbestos or lead paint. Homes with wells or septic systems might need those components inspected separately. Understanding these nuances ensures comprehensive knowledge about what you're buying.

While waiving a home inspection might make your offer more appealing in competitive markets, it's essential to weigh this against potential long-term costs and risks. A thorough home inspection is an invaluable tool that helps protect your investment by uncovering hidden problems and providing negotiating power.

Ultimately, each buyer's situation is unique. Consulting with your real estate agent and considering factors such as market conditions and property specifics will help you make an informed decision about whether to include a home inspection in your purchase process. Remember, it's better to invest time and money upfront than face unexpected surprises down the road.

GET OUR LATEST HOME BUYER GUIDE!

Jim Armstrong

REALTOR/Certified Real Estate Instructor

978-394-6736

jarmstrong@armstrongfield.com

Categories

- All Blogs (99)

- Beverly, MA (4)

- Buying a Home (42)

- Condos For Sale (3)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (11)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (49)

Recent Posts