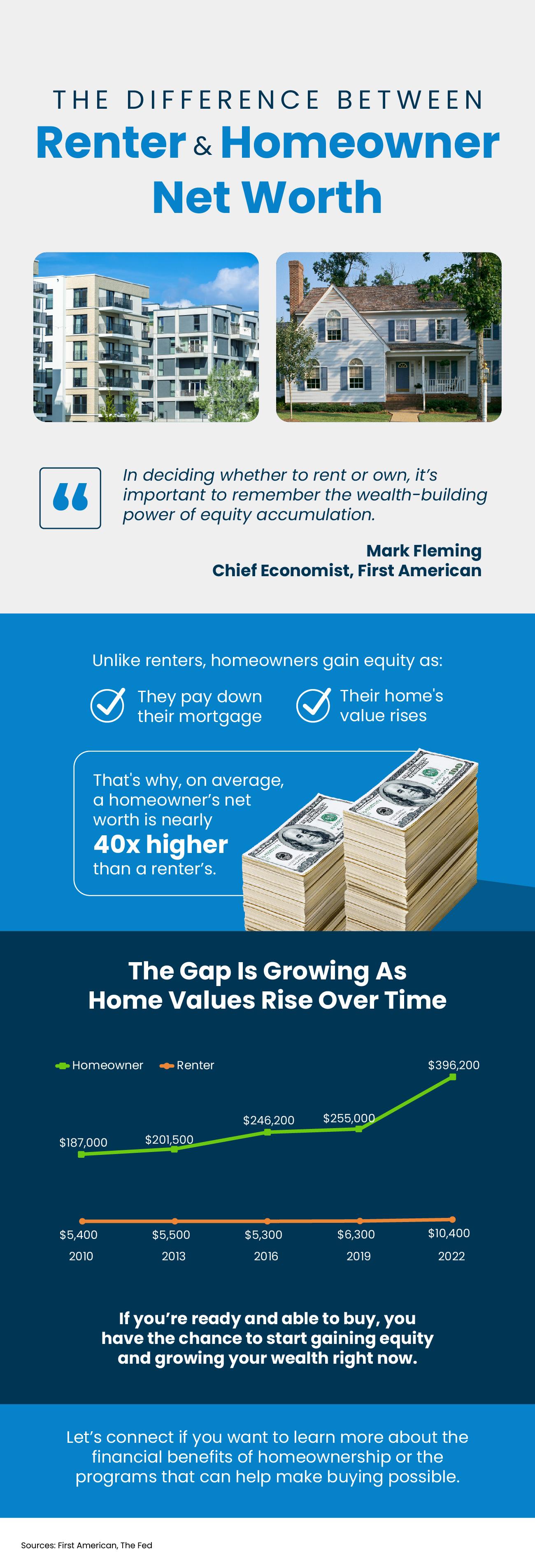

The Big Difference Between Renter and Homeowner Net Worth

Some Highlights

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Connect with an agent if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Categories

- All Blogs (579)

- Beverly, MA (4)

- Buying a Home (247)

- Condos For Sale (3)

- Home Ownership (97)

- Homes For Sale (7)

- Living on the North SHore (7)

- Mortgages (35)

- Prospective Real Estate Agents (2)

- Real Estate Careers (9)

- Real Estate Market Conditions (138)

- Real Estate School (1)

- Renting (3)

- Salem, MA (4)

- Selling a home (199)

Recent Posts

Essential Legal Disclosures & Permits for Home Sellers (Salem, MA Edition)

Why October 2025 Is a Smart Time to Buy a Home in Massachusetts

What is the Best Area or neighborhood in Salem, MA to Buy a Home?

International Coffee Day - Coffee & Real Estate: A Perfect Blend

A Comprehensive Guide to Buyer Closing Costs

So, What Happens After You Accept an Offer on Your Home?

Selling a Home That’s Part of an Estate: Understanding the Probate Process and Timeline

Understanding Capital Gains Tax on Home Sales: What You Need to Know

Non-Real Estate Related, but Important Post about Prostate Cancer

Selling Your Home in 2026? It’s Not Too Early to Start Getting Ready