A Comprehensive Guide to Buyer Closing Costs

Closing Costs 101: What Every Homebuyer Needs to Know

Buying a home is exciting—you’re picking neighborhoods, imagining your furniture in new rooms, and counting down to move-in day.

But amid all the talk about down payments, there’s another big piece of the puzzle that buyers often underestimate: closing costs.

These are the fees and expenses—paid to lenders, attorneys, and other service providers—that make your purchase official.

While the down payment builds your initial equity, closing costs pay for everything from legal filings to loan processing and property services.

If you don’t budget for them early, they can catch you off guard and create serious last-minute stress.

What Are Closing Costs?

Closing costs are the one-time fees required to transfer the property into your name and finalize your mortgage.

They’re completely separate from your down payment.

Your down payment might be 3% for an FHA loan or 20% for a conventional loan, but closing costs typically cover services such as:

-

Loan-related fees – lender charges for processing and underwriting your mortgage

-

Appraisals & inspections – verifying the home’s value and condition

-

Title search & insurance – ensuring the seller has clear ownership

-

Government fees & taxes – recording the deed, transfer taxes, and more

It’s easy to lump all upfront cash together as “the down payment,” but these are two very different buckets.

Recognizing that you’ll need to fund both is key to smart budgeting.

How Much Should You Expect to Pay?

How Much Should You Expect to Pay?

A good rule of thumb: 2% to 5% of the home’s purchase price.

For a $300,000 home, that’s roughly $6,000 to $15,000.

In high-price markets, that number can be far higher.

For example, a $615,000 home in Massachusetts could bring closing costs of $12,000 to $30,000+, and a $955,000 home in Milton might mean $19,000 to $47,000.

Several factors influence your final number:

-

Loan type – FHA, VA, or conventional loans all have different fee structures.

-

Location – Some states require attorneys at closing, and local transfer taxes vary widely.

-

Home price – Fixed fees (like credit reports) represent a bigger percentage on lower-priced homes.

-

Lender fees – Origination and underwriting charges differ from one lender to another.

-

Negotiations – Seller credits or service-provider discounts can lower your costs.

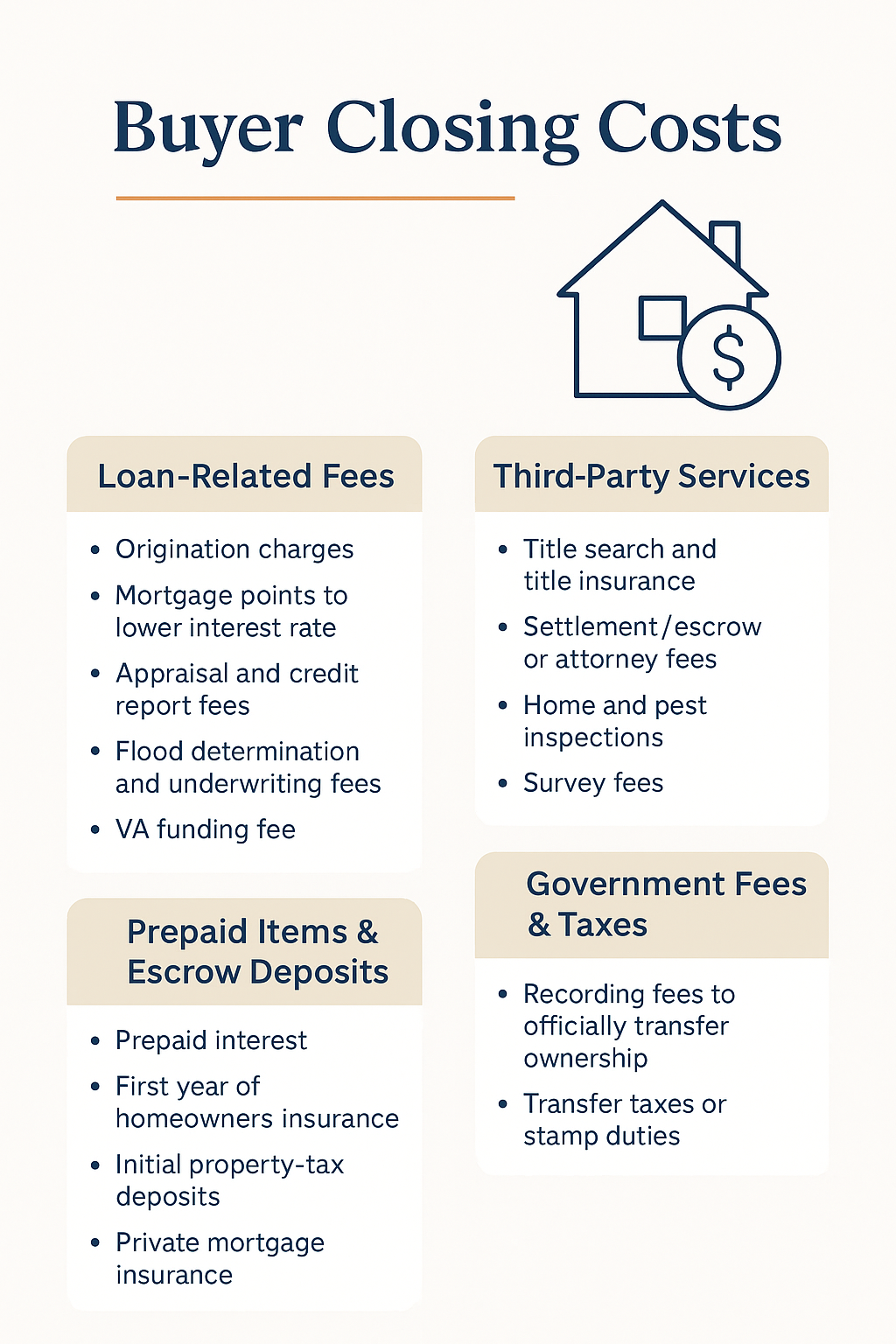

Typical Buyer Closing Costs

Here’s a quick breakdown of the main categories:

Loan-Related Fees

-

Origination charges (application, processing, underwriting)

-

Mortgage points to lower your interest rate (optional)

-

Appraisal and credit report fees

-

Flood determination and underwriting fees

-

VA funding fee (for VA loans)

Third-Party Services

-

Title search and title insurance (lender’s policy required; buyer’s policy optional but smart)

-

Settlement/escrow or attorney fees

-

Home and pest inspections

-

Survey fees (if required)

Prepaid Items & Escrow Deposits

-

Prepaid interest (from closing date to month’s end)

-

First year of homeowners insurance

-

Initial property-tax deposits

-

Private mortgage insurance (if your down payment is under 20%)

-

HOA transfer or capital contribution fees

Government Fees & Taxes

-

Recording fees to officially transfer ownership

-

Transfer taxes or stamp duties (state/county dependent)

Key Documents to Review

Two federally required forms help you understand and verify your closing costs:

-

Loan Estimate (LE) – Provided within three business days of your mortgage application, this outlines estimated costs and loan terms so you can compare lenders.

-

Closing Disclosure (CD) – Delivered at least three business days before closing, this shows the final, exact costs. Compare it carefully to your Loan Estimate to catch discrepancies before signing.

These documents protect you by providing transparency—and time to ask questions.

Smart Ways to Lower Your Closing Costs

Closing costs are unavoidable, but you can take steps to keep them manageable:

-

Shop Around – Get Loan Estimates from multiple lenders and compare origination fees, not just interest rates.

-

Compare Service Providers – For items labeled “Services You Can Shop For” (like title or pest inspection), get multiple quotes.

-

Negotiate Lender Fees – Ask for discounts on origination or underwriting charges.

-

Request Seller Credits – In some markets, sellers may agree to pay part of your closing costs.

-

Consider Assistance Programs – State or local grants can help first-time buyers with both down payments and closing costs.

-

Time Your Closing – Closing at the end of the month reduces prepaid interest.

-

Boost Your Credit – A stronger score may qualify you for better loan terms and lower fees.

-

No-Closing-Cost Loans – Some lenders will cover costs in exchange for a slightly higher interest rate—good for cash-strapped buyers but more expensive over time.

-

Roll Costs Into the Loan – Possible with some lenders, but you’ll pay interest on the added amount.

Closing costs typically range from 2% to 5% of your purchase price, and they’re separate from your down payment.

By understanding each fee, carefully reviewing your Loan Estimate and Closing Disclosure, and using smart cost-saving strategies, you’ll walk into closing day confident and prepared—without unpleasant surprises.

Planning for these expenses early is one of the best steps you can take toward a smooth, stress-free path to homeownership.

Jim Armstrong

REALTOR

Real Estate Broker

Massachusetts Certified Real Estate Instructor

Categories

- All Blogs (99)

- Beverly, MA (4)

- Buying a Home (42)

- Condos For Sale (3)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (11)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (49)

Recent Posts