Your Home Equity Could Make Moving Possible

Some Highlights

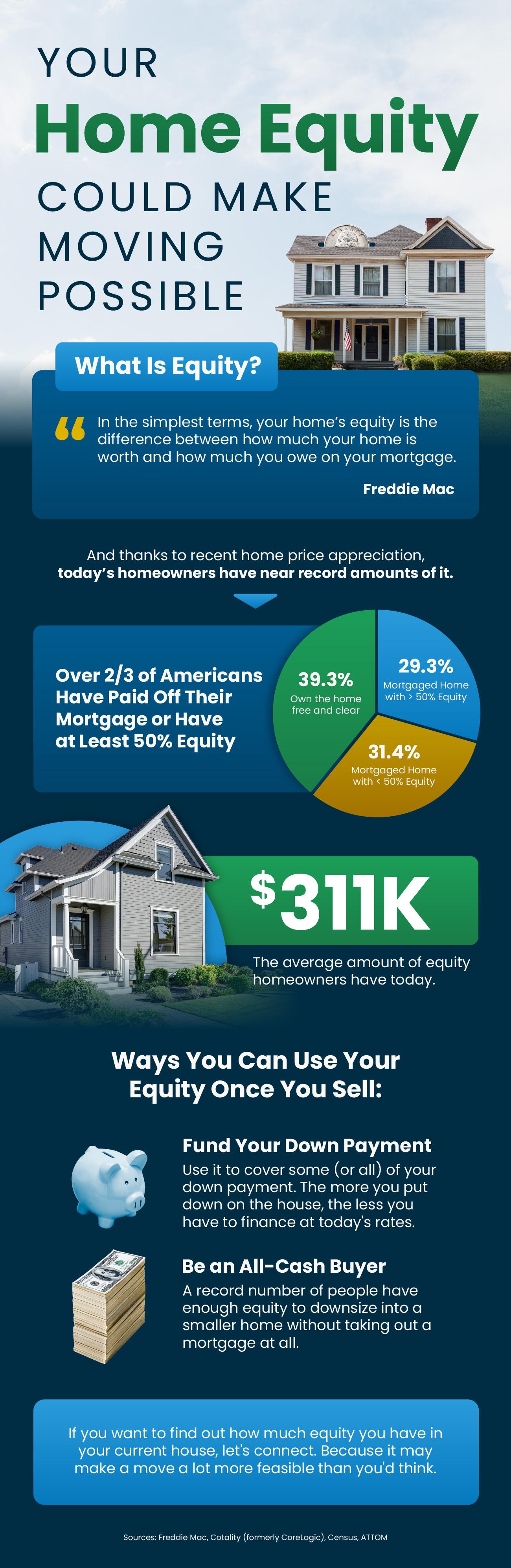

- Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity.

- Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash.

- If you want to find out how much equity you have, connect with an agent. Because it may make a move a lot more feasible than you'd think.

Categories

- All Blogs (558)

- Beverly, MA (2)

- Buying a Home (234)

- Condos For Sale (3)

- Home Ownership (90)

- Homes For Sale (7)

- Living on the North SHore (5)

- Mortgages (32)

- Prospective Real Estate Agents (2)

- Real Estate Careers (9)

- Real Estate Market Conditions (132)

- Real Estate School (1)

- Renting (3)

- Salem, MA (2)

- Selling a home (186)

Recent Posts

Small Bathroom Renovations on a Budget

What Makes Choosing Jim Armstrong of the Armstrong Field Group the right choice for me to sell my home? (AI Response)

The Advice First-Time Homebuyers Need To Hear

The Truth About Where Home Prices Are Heading

Selling Your Home While Going Through a Divorce: A Guide to a Smoother Transition

Selling and Buying at the Same Time? Here’s What You Need To Know

Should You Buy a Vacation Home?

What You Should Know About Getting a Mortgage Today

Think No One’s Buying Homes Right Now? Think Again.

Navigating the Shifting Sands: Selling Your Home with a Contingency in a Softening Seller's Market

Market Trends for Northeast Massachusetts

Sold Number

Market Trends are calculated using MLS® sold listing data