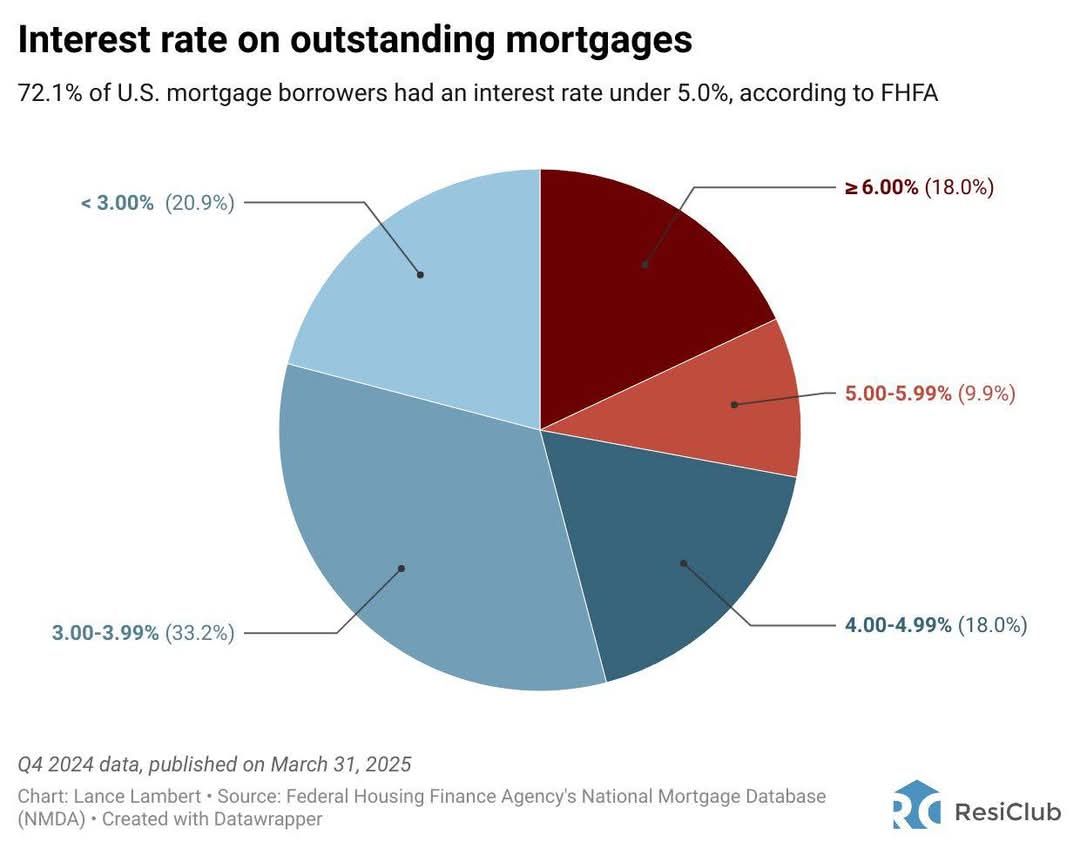

Interest Rates on Outstanding Mortgages

Did you know that a significant majority – 72.1% – of U.S. mortgage borrowers are currently enjoying interest rates below 5.0%? That's according to the latest FHFA data from Q4 2024! Looking at the breakdown, a large portion has rates in the 3.00-3.99% (33.2%) and < 3.00% (20.9%) ranges.

With today's average mortgage rates hovering around 6.7-6.8% (as of April 2, 2025), it's no surprise that many homeowners with these lower locked-in rates feel little incentive to sell and buy a new home. Why would they trade their historically low monthly payments for a significantly higher one?

This "lock-in effect" is a major factor influencing today's real estate market. It's contributing to lower inventory as existing homeowners are choosing to stay put rather than face much higher borrowing costs. This can create challenges for potential buyers as there are fewer homes on the market to choose from, potentially leading to continued price pressure in some areas.

What are your thoughts on this? Are you a homeowner with a low interest rate feeling "locked in"? Or are you a buyer navigating this landscape? Share your experiences in the comments below!

Categories

- All Blogs (99)

- Beverly, MA (4)

- Buying a Home (42)

- Condos For Sale (3)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (11)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (49)

Recent Posts

2026 Real Estate Outlook: What Buyers, Sellers & Investors Should Know

5 Essex County Massachusetts neighborhoods where $700K tends to stretch the farthest

Welcome to the North Shore: A Guide to Living in Danvers, MA

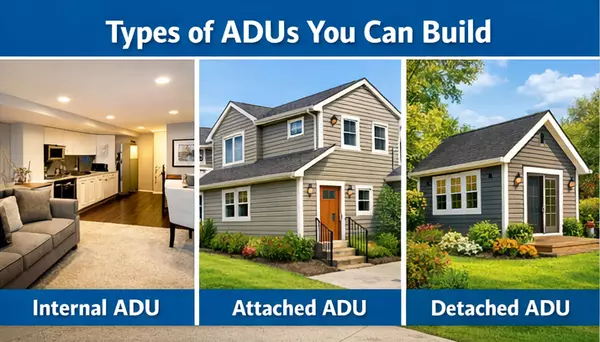

What Are ADUs & Why They Matter in Massachusetts | 2025/2026 Update

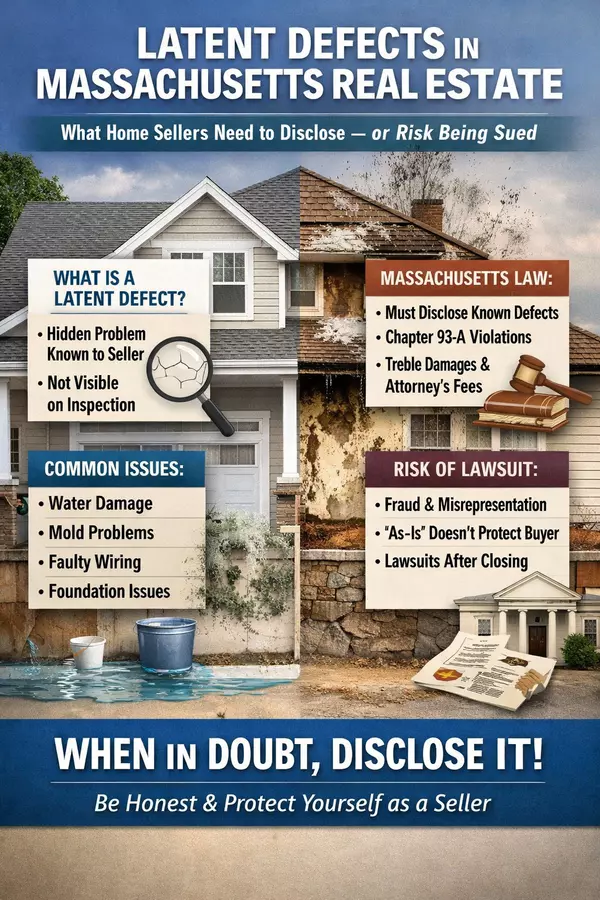

Latent Defects in Massachusetts Real Estate | Seller Disclosure Laws

Why Home Sellers Shouldn’t Choose an Agent Based on Price Alone: The Truth About “Buying a Listing”

Living in Beverly, Massachusetts in 2025/2026 – Pros & Cons

What are Massachusetts Homeowners REAL Options in 2026?

What Are Portable Mortgages—and Could They Boost Housing Inventory in the U.S.?

Smart Home Features That will Actually Increase Your Property Value in 2026