NAR working on getting the $500K capital gains exclusion raised

The National Association of Realtors (NAR) is actively lobbying Congress to raise the capital gains exclusion on the sale of a primary residence

. Currently, homeowners can exclude up to $250,000 for single filers and $500,000 for married couples in profits from federal capital gains tax when selling their primary home. These limits were set in 1997 and have not been adjusted for inflation.

NAR argues that this outdated exclusion creates a "stay-put penalty" and exacerbates the housing inventory shortage.

NAR supports the following proposals to address the issue:

- The More Homes on the Market Act: This bipartisan bill would double the exclusion to $500,000 for individuals and $1 million for married couples, and index it for future inflation. The bill was introduced in February 2025 and has over 80 cosponsors.

- The No Tax on Home Sales Act: This bill, introduced in July 2025, would eliminate the capital gains tax on the sale of primary residences entirely, without limit. President Trump has also indicated he is considering this idea.

Key Advocacy Points

- Protecting Homeowner Equity: With home prices significantly appreciating since 1997, many homeowners, especially those who have owned their homes for a long time, are facing unexpected tax bills when they sell. NAR's research indicates that 34% of homeowners (29 million) may already exceed the $250,000 cap. This figure is projected to reach 56% by 2030 and nearly 70% by 2035.

- Increasing Housing Supply: The capital gains tax disincentive discourages homeowners, particularly seniors, from selling their homes, which limits the available housing stock for other buyers. Raising or eliminating the exclusion is seen as a way to unlock millions of homes.

- Restoring Fairness: The current law was intended to incentivize homeownership and protect the middle class, but inflation has eroded the exclusion's value, disproportionately affecting middle-class homeowners who have built equity over time.

Categories

- All Blogs (102)

- Beverly, MA (5)

- Buying a Home (44)

- Condos For Sale (3)

- Danvers, MA (1)

- Home Ownership (28)

- Homes For Sale (7)

- Living on the North SHore (12)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (20)

- Real Estate School (1)

- Salem, MA (7)

- Selling a home (50)

Recent Posts

Moving to the North Shore of Massachusetts

Why Massachusetts Is the #1 Place to Raise a Family in 2026 (And Why So Many Families Are Moving Here)

5 Tips for Choosing the Right Estate AgentFive Tips for Choosing the Right Estate Agent

2026 Real Estate Outlook: What Buyers, Sellers & Investors Should Know

5 Essex County Massachusetts neighborhoods where $700K tends to stretch the farthest

Welcome to the North Shore: A Guide to Living in Danvers, MA

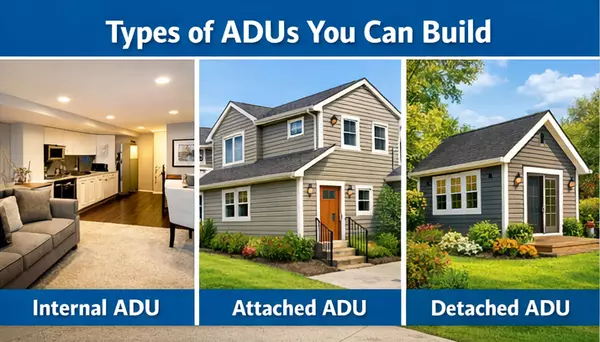

What Are ADUs & Why They Matter in Massachusetts | 2025/2026 Update

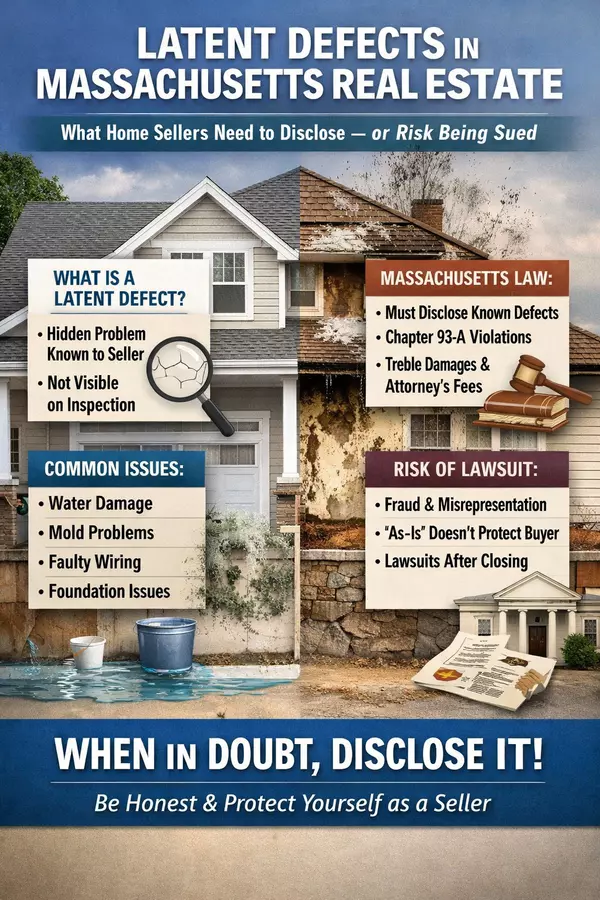

Latent Defects in Massachusetts Real Estate | Seller Disclosure Laws

Why Home Sellers Shouldn’t Choose an Agent Based on Price Alone: The Truth About “Buying a Listing”

Living in Beverly, Massachusetts in 2025/2026 – Pros & Cons