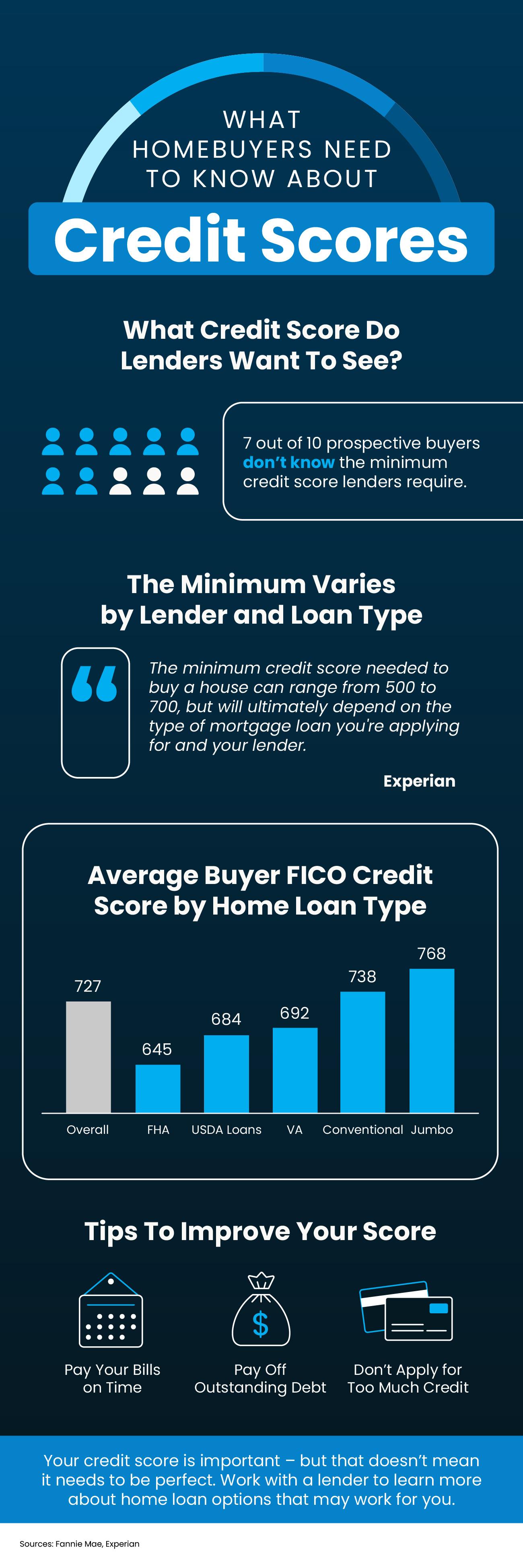

What Homebuyers Need To Know About Credit Scores

Some Highlights

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

Categories

- All Blogs (556)

- Beverly, MA (2)

- Buying a Home (233)

- Condos For Sale (3)

- Home Ownership (89)

- Homes For Sale (7)

- Living on the North SHore (5)

- Mortgages (32)

- Prospective Real Estate Agents (2)

- Real Estate Careers (9)

- Real Estate Market Conditions (131)

- Real Estate School (1)

- Renting (3)

- Salem, MA (2)

- Selling a home (184)

Recent Posts

The Advice First-Time Homebuyers Need To Hear

The Truth About Where Home Prices Are Heading

Selling Your Home While Going Through a Divorce: A Guide to a Smoother Transition

Selling and Buying at the Same Time? Here’s What You Need To Know

Should You Buy a Vacation Home?

What You Should Know About Getting a Mortgage Today

Think No One’s Buying Homes Right Now? Think Again.

Navigating the Shifting Sands: Selling Your Home with a Contingency in a Softening Seller's Market

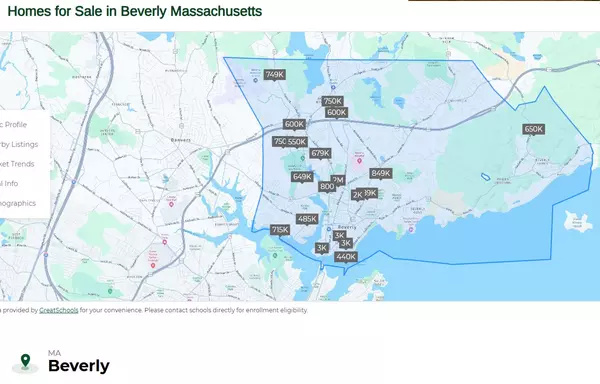

Navigating the Beverly, MA Real Estate Market: Your 2025 Seller's Guide

Discovering Your Dream Home in Beverly, MA: A Neighborhood Guide

Market Trends for Northeast Massachusetts

Sold Number

Market Trends are calculated using MLS® sold listing data