Essex County Real Estate Insights - September 2023

Essex County Real Estate Insights - September 2023 Your Source for the Latest Real Estate Trends and Market Data In This Month's Issue: Market Overview Median Home Prices Hot Neighborhood Spotlight Featured Real Estate Agent Upcoming Events Real Estate Tip of the Month 1. Market Overview As we step

Read MoreHow do I sell and buy a home at the same time?

Selling a home and buying a new one can be a daunting task, especially when you want to do both at the same time. There are many things to consider such as timing, financing, and making sure that everything goes smoothly. In this blog post, we will explore some tips on how to sell and buy a home at

Read More

Categories

Recent Posts

Moving to the North Shore of Massachusetts

Why Massachusetts Is the #1 Place to Raise a Family in 2026 (And Why So Many Families Are Moving Here)

5 Tips for Choosing the Right Estate AgentFive Tips for Choosing the Right Estate Agent

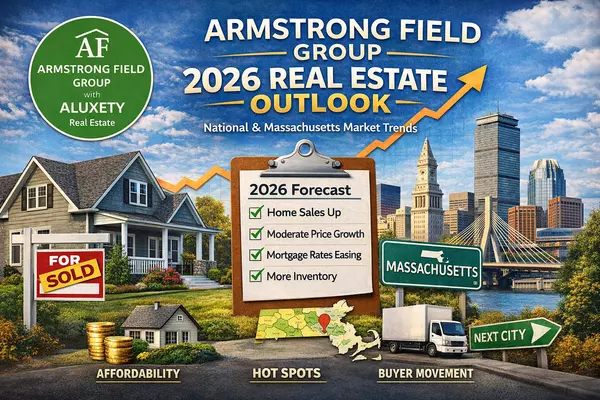

2026 Real Estate Outlook: What Buyers, Sellers & Investors Should Know

5 Essex County Massachusetts neighborhoods where $700K tends to stretch the farthest

Welcome to the North Shore: A Guide to Living in Danvers, MA

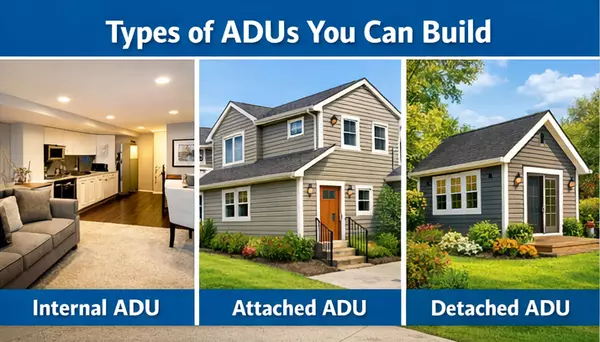

What Are ADUs & Why They Matter in Massachusetts | 2025/2026 Update

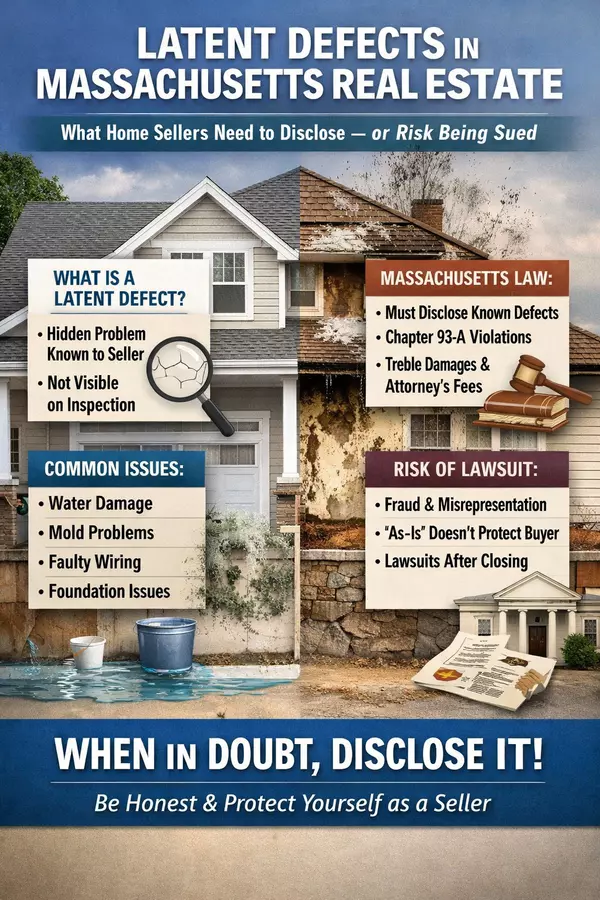

Latent Defects in Massachusetts Real Estate | Seller Disclosure Laws

Why Home Sellers Shouldn’t Choose an Agent Based on Price Alone: The Truth About “Buying a Listing”

Living in Beverly, Massachusetts in 2025/2026 – Pros & Cons