What Buyers Need To Know About Homeowners Association Fees

When buying a home, you’re probably thinking about mortgage rates, home prices, your down payment, and maybe even your closing costs. But you may not be thinking about homeowners association (HOA) fees. While you won’t necessarily have these, you should know it’s a possibility, depending on where yo

Read MoreYou Could Use Some of Your Equity To Give Your Children the Gift of Home

If you’re a homeowner, chances are you’ve built up a lot of wealth – just by living in your house and watching its value grow over time. And that equity? It’s something that could help change your child’s life.Since affordability is still a challenge, a lot of first-time buyers are struggling to buy

Read MoreDon’t Let Student Loans Hold You Back from Homeownership

Did you know? According to a recent study, 72% of people with student loans think their debt will delay their ability to buy a home. Maybe you’re one of them and you're wondering:Do you have to wait until you’ve paid off those loans before you can buy your first home?Or is it possible you could stil

Read MoreWhy Buyers Are More Likely To Get Concessions Right Now

Especially in areas where inventory is rising, both homebuilders and sellers are sweetening the deal for buyers with things like paid closing costs, mortgage rate buy-downs, and more. In the industry, it’s called a concession or an incentive.What Are Concessions and Incentives?When a seller or build

Read MoreEmbracing the Future: Why a Green Home Makes Perfect Sense

Embracing the Future:Why a Green Home Makes Perfect Sense In an era of increasing environmental awareness and fluctuating energy costs, the concept of a "green" home – designed for energy efficiency and sustainability – is no longer a niche trend but a smart, practical choice for homeowners. Opting

Read MoreWhy You’ll Want a Home Inspection

Some HighlightsOnce your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more.That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip th

Read MoreThe 20% Down Payment Myth, Debunked

Saving up to buy a home can feel a little intimidating, especially right now. And for many first-time buyers, the idea that you have to put 20% down can feel like a major roadblock.But that’s actually a common misconception. Here’s the truth.Do You Really Have To Put 20% Down When You Buy a Home?Unl

Read MoreYour Home Equity Could Make Moving Possible

Some HighlightsThanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity.Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash. If you w

Read MorePaused Your Moving Plans? Here’s Why It’s Time To Hit Play Again

It’s not really a surprise that 70% of buyers paused their home search last year. Maybe you were one of them. And if so, no judgment. Conditions just weren’t great.Inventory was too low, prices were too high, and mortgage rates were bouncing all over. That made it really hard to find a home you love

Read MoreYou Finally Have More Options for Your Move

Some HighlightsIf you put your home search on hold because you couldn’t find anything you liked in your budget, it’s time to try again. There’s a much wider selection of homes for sale, with more fresh listings hitting the market each month.With more options come more possibilities. Connect with an

Read MoreShould I Buy a Home Now or Wait?

At some point, you’ve probably heard the saying: “Yesterday was the best time to buy a home, but the next best time is today.”That’s because homeownership is about the long game – and home prices typically rise over time. So, while you may be holding out for prices to fall or rates to improve, you s

Read MoreWhat You Can Do When Mortgage Rates Are a Moving Target

Have you seen where mortgage rates have been lately? One day they go down a little. The next day, they go back up again. It can feel confusing and even frustrating if you’re trying to decide whether now’s a good time to buy a home.Take a look at the graph below. It uses data from Mortgage News Daily

Read MorePre-Approval Isn’t Commitment – It’s Clarity

If buying a home is on your radar – even if it’s more of a someday plan than a right now plan – getting pre-approved early is still one of the smartest moves you can make. Why? Because, like anything in life, the right prep work makes things clearer.The best time to get serious about buying is befor

Read MoreAre You Saving Up To Buy a Home? Your Tax Refund Can Help

You’ve been working on your savings and dreaming of that moment when you finally have keys to a place that’s truly yours. What you might not realize is that your tax return could give you a little extra cash to help you get there sooner. As Freddie Mac notes:“ . . . your tax refund from the IRS can

Read More4 Ways To Make an Offer That Stands Out This Spring

Now that spring is here, more and more buyers are jumping back into the market, and competition is heating up.If you’re serious about landing a home you’ll love, you need more than just a wish list. You need a smart strategy – and that starts with working with a great agent who can help you put toge

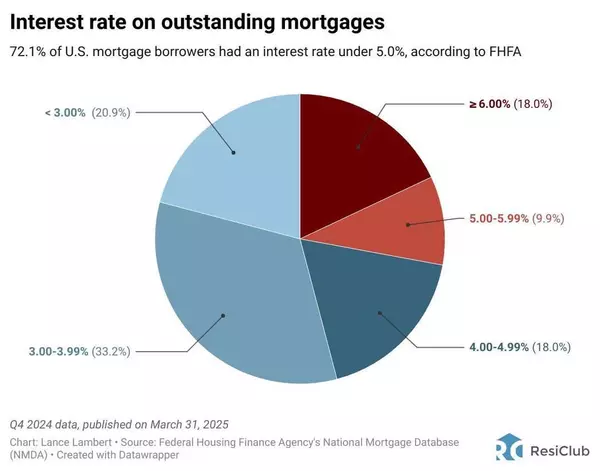

Read MoreInterest Rates on Outstanding Mortgages

Real Estate Market Update! Did you know that a significant majority – 72.1% – of U.S. mortgage borrowers are currently enjoying interest rates below 5.0%? That's according to the latest FHFA data from Q4 2024! Looking at the breakdown, a large portion has rates in the 3.00-3.99% (33.2%) and

Read MoreTownhomes: A Smart Solution for Today’s First-Time Buyers

Buying your first home in today’s market can feel tough. Between high home prices and mortgage rates, affordability is still a big challenge. And some buyers are making one simple trade-off that’s getting them in the door faster: square footage.According to the National Association of Home Builders

Read MoreNavigating the Homebuying Journey: A Step-by-Step Guide

Navigating the Homebuying Journey: A Step-by-Step Guide to Your Dream Home Buying a home is a significant milestone, but it can also feel overwhelming. To demystify the process, here's a comprehensive guide outlining the essential steps to take: 1. Understand the Current Housing Market: The real e

Read MoreBuyers Have More Negotiation Power – Here’s How To Use It

You may have heard there are more homes for sale right now. And while that’ll vary depending on the market, it means that overall, things are starting to lean in a more balanced direction. As that happens, some sellers are a bit more open to compromise. Here’s what that means for you.You may be rega

Read MoreWhy Pre-Approval Is More Important Than Ever This Spring

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want to put yourself in the best position to buy, there’s one step you can’t afford to skip, and that’s getting pre-approved for a mortgage.Some buyers thi

Read More

Categories

Recent Posts