Where Will I Move? A Homeowner’s Guide to Navigating the Big Question

Where Will I Move? A Homeowner’s Guide to Navigating the Big Question

One of the biggest questions homeowners have when considering a sale is, "Where will I move?" It's a valid concern, one that can often feel paralyzing in a rapidly shifting real estate market. The fear of selling your current home only to be left scrambling for a new one is a significant hurdle. The key, however, is to look at the full picture. By understanding the market, exploring your options, and creating a solid plan, you can turn this daunting question into an exciting opportunity.

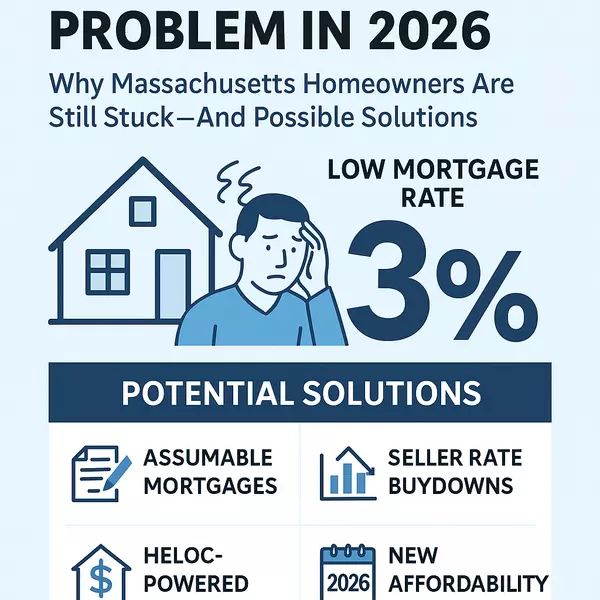

Recent market trends are beginning to offer a glimmer of hope for sellers who are also buyers. After a period of intense competition and limited inventory, the landscape is showing signs of rebalancing. An increase in the number of homes for sale means more options and potentially less pressure for those looking to make their next move. While every local market is unique, this national shift provides a welcome tailwind for homeowners who have been waiting on the sidelines.

The Full Picture: More Than Just a For-Sale Sign in the Yard

Successfully navigating the sale of your current home and the purchase of a new one requires a holistic approach. It’s about more than just timing the market; it’s about understanding your personal and financial readiness for the transition.

A Financial Deep Dive: Know Your Numbers

Before you even think about browsing online listings, it’s crucial to have a firm grasp on your finances. This means:

- Getting Pre-Approved for Your Next Mortgage: This is a critical first step. A pre-approval will give you a clear understanding of your budget and show sellers that you are a serious contender. In a market with more options, a strong financial position can be a significant advantage.

- Understanding Your Home’s Equity: Calculate the potential proceeds from the sale of your current home. This will be a key factor in determining your down payment and overall budget for your next purchase.

- Exploring Bridge Loans and Other Financing Options: If you find your dream home before you’ve sold your current one, a bridge loan can provide the short-term financing needed to "bridge" the gap. It’s wise to research these options in advance so you’re prepared for any scenario.

A Self-Assessment: What Do You Really Need (and Want)?

A Self-Assessment: What Do You Really Need (and Want)?

The perfect home isn’t just about the number of bedrooms and bathrooms. Take the time to assess your lifestyle and future needs.

- List Your Must-Haves and Nice-to-Haves: Be realistic about your absolute necessities versus the features that would be a bonus. This will help you focus your search and make quicker decisions when the right property comes along.

- Consider a Different Location: Are you tied to your current neighborhood, or could a different area offer more of what you’re looking for at a better price point? Expanding your search can reveal hidden gems.

- Think Long-Term: Is this your forever home, or a stepping stone for the next 5-7 years? Your answer will influence the type of property and location that makes the most sense.

Market Realities and Strategic Maneuvers

While the market may be tilting in a more buyer-friendly direction, strategy is still key.

- Contingency Offers: You can make an offer on a new home that is contingent on the sale of your current property. While this can sometimes make your offer less attractive to sellers, in a less frenzied market, they may be more willing to consider it.

- The Leaseback Option: A "rent-back" or "leaseback" agreement allows you to sell your home and then rent it back from the new owners for a specified period. This can provide you with the funds from your sale while giving you extra time to find and close on your next home.

- Don’t Neglect Your Sale: In your eagerness to find a new home, don’t forget the importance of properly preparing your current one for the market. A well-presented and strategically priced home is more likely to sell quickly and for a good price, which will put you in a stronger buying position.

Planning Over Panic

The question of "Where will I move?" doesn't have to be a source of anxiety. By taking a proactive and informed approach, you can navigate the process with confidence. Assemble a team of trusted professionals, including a knowledgeable real estate agent and a mortgage lender, who can provide expert guidance tailored to your specific situation.

Looking at the full picture reveals that with careful planning, financial preparedness, and a clear understanding of your goals, the path to your next front door can be a smooth and rewarding journey.

Categories

- All Blogs (97)

- Beverly, MA (4)

- Buying a Home (40)

- Condos For Sale (3)

- Home Ownership (27)

- Homes For Sale (7)

- Living on the North SHore (10)

- Mortgages (4)

- Prospective Real Estate Agents (1)

- Real Estate Careers (8)

- Real Estate Market Conditions (19)

- Real Estate School (1)

- Salem, MA (6)

- Selling a home (48)

Recent Posts