New Home Construction in Massachusetts is Applealing to More Buyers

Why More Buyers Are Turning to New Construction This Year In 2025, a noticeable shift has emerged in the the homebuying landscape: a growing share of buyers are opting for new construction over resale homes. Whether you’re a first-time buyer, a move-up buyer, or someone downsizing, there are compell

Read MoreWhy You Can No Longer Waive a Home Inspection in Massachusetts (As of Oct 2025)

Massachusetts’s New Home-Inspection Law: What Buyers, Sellers & Agents Need to Know In 2024, Massachusetts passed a significant change to how home inspections can be handled in residential real estate transactions. As of sales with contracts dated after October 15, 2025, buyers and sellers must foll

Read MoreTop 10 Things to Know When Visiting Salem, MA in October

Top 10 Things to Know When Visiting Salem, MA in October Salem, Massachusetts, is a place steeped in history, charm, and mystery, and October is the perfect time to experience its unique atmosphere. While Salem is most famous for its witch trials and spooky lore, there is so much more to discover, f

Read MoreThe Art of Negotiation: How to Get the Best Offer When Selling Your Home

Selling a home is more than just listing it online—it’s about mastering the art of negotiation. Whether you’re dealing with first-time buyers or seasoned investors, the way you negotiate determines how much profit you make and how quickly you close. In this guide, we’ll break down proven real estate

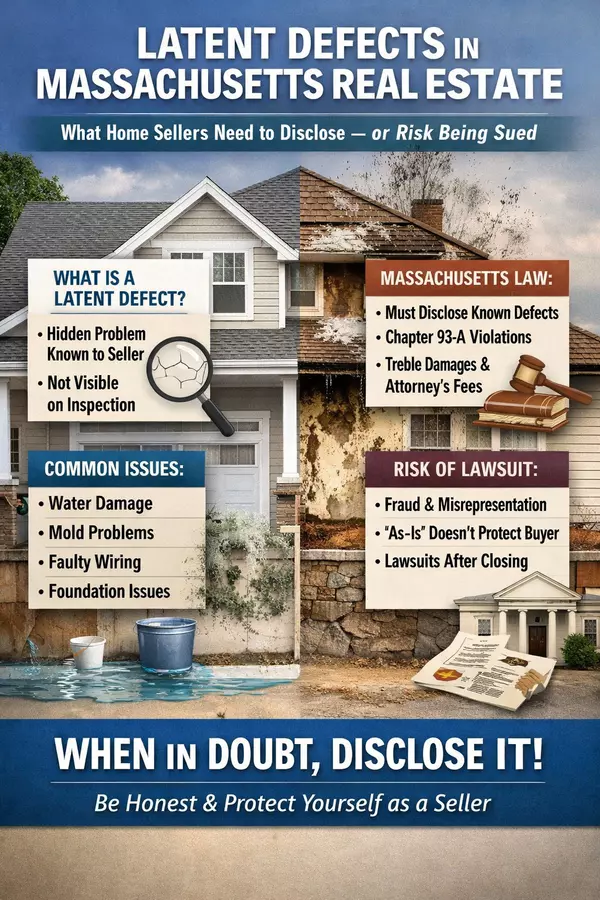

Read MoreEssential Legal Disclosures & Permits for Home Sellers (Salem, MA Edition)

This critical blog post will detail the specific legal obligations and permit considerations for selling a home in Massachusetts, ensuring sellers navigate the process without legal pitfalls. While Massachusetts is often characterized as a "buyer beware" (caveat emptor) state, the reality for seller

Read MoreWhy October 2025 Is a Smart Time to Buy a Home in Massachusetts

Why October 2025 Is a Smart Time to Buy a Home in Massachusetts If you’re considering buying a home in Massachusetts in 2025, October might be your best window. The fall season brings a confluence of market trends, seasonal behavior, and regional dynamics that favor buyers—especially this year. Belo

Read MoreWhat is the Best Area or neighborhood in Salem, MA to Buy a Home?

What is the Best Area in Salem, MA to Buy a Home? If you’re thinking about buying a home in Salem, Massachusetts, you’re not alone. Known for its rich history, vibrant downtown, and seaside charm, Salem has become one of the most desirable communities on the North Shore. But with so many unique neig

Read MoreInternational Coffee Day - Coffee & Real Estate: A Perfect Blend

Coffee & Real Estate: A Perfect Blend ☕🏡 Today is International Coffee Day, and as someone who lives on equal parts coffee and real estate, I couldn’t help but notice how much these two worlds overlap. That First Sip, That First Impression Just like that first sip of morning coffee can set the to

Read MoreA Comprehensive Guide to Buyer Closing Costs

Closing Costs 101: What Every Homebuyer Needs to Know Buying a home is exciting—you’re picking neighborhoods, imagining your furniture in new rooms, and counting down to move-in day.But amid all the talk about down payments, there’s another big piece of the puzzle that buyers often underestimate:

Read MoreSo, What Happens After You Accept an Offer on Your Home?

What Happens After You Accept an Offer on Your Home? Once you accept an offer, several steps follow before closing — these include inspections, having a Purchase & Sale agreement drafted (with possible addenda), appraisal (if financing is involved), and ensuring local safety/code requirements like s

Read MoreSelling a Home That’s Part of an Estate: Understanding the Probate Process and Timeline

Selling a Home That’s Part of an Estate: Understanding the Probate Process and Timeline Selling a home after the death of a loved one can be emotionally and legally complex. If the property is part of an estate, you’ll likely encounter probate, the court-supervised process for transferring ownersh

Read MoreUnderstanding Capital Gains Tax on Home Sales: What You Need to Know

Understanding Capital Gains Tax on Home Sales: What You Need to Know Selling your home can be exciting—whether you’re upgrading, downsizing, or relocating. But before you celebrate your sale, it’s important to understand how capital gains tax may (or may not) affect the profits from your home. Knowi

Read MoreNon-Real Estate Related, but Important Post about Prostate Cancer

My Journey with Prostate Cancer—and Why Every Man Over 50 Should Get Tested I rarely share personal health updates on social media or in public, whether good or bad. But this time is different. I feel strongly about using my experience to spread awareness about prostate cancer—the second leading cau

Read MoreSelling Your Home in 2026? It’s Not Too Early to Start Getting Ready

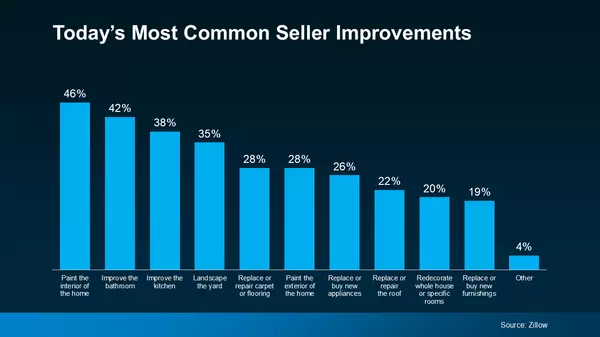

Selling Your Home in 2026? It’s Not Too Early to Start Getting Ready Thinking about selling your house in 2026? I know it sounds far away, but trust me—it’s not too early to start prepping. Even though the calendar says you’ve got plenty of time, getting a head start on repairs and updates can save

Read More5 Beverly, MA neighborhoods where You'll get the best value for a budget of $700,000

Here are five Beverly, MA neighborhoods that typically deliver strong value around $700,000, weighing schools, commute, safety, and long-term upside. I’ll give you the “why,” the best buyer fits, and any watch-outs—plus sources so you can sanity-check the claims. 1) Ryal Side Why it’s a good value:

Read MoreNAR working on getting the $500K capital gains exclusion raised

The National Association of Realtors (NAR) is actively lobbying Congress to raise the capital gains exclusion on the sale of a primary residence . Currently, homeowners can exclude up to $250,000 for single filers and $500,000 for married couples in profits from federal capital gains tax when sell

Read MoreFinancing Options for Home Buyers

Purchasing a home is one of the most significant financial decisions many people will make. Understanding the various Massachusetts home financing options can help buyers select the loan program that best fits their budget, credit profile, and long-term goals. Below is an overview of the most common

Read MoreIs Now the Right Time to Sell? Key Market Factors to Consider for the North Shore of Massachusetts

1. Local Real Estate Climate: Still a Strong Seller’s Market On the North Shore, the real estate market remains highly favorable for sellers. In May 2025, single-family home inventory was down significantly, with median sale prices rising nearly 6% year-over-year. Pending sales also climbed about 10

Read More6 Myths About Mortgages That May Keep You From Buying a Home

Home-Buying Myths That Could Be Holding You Back Thinking you’re not ready to buy a home yet? Many renters assume the financial barriers are too high, but much of what people believe about mortgages simply isn’t true. Let’s clear up some of the most common myths so you can feel more confident abou

Read MoreFAQ for Home Sellers in Massachusetts

Frequently Asked Questions for Home Sellers Selling a home can be a complex process, and it's natural to have questions. Here are some of the most frequently asked questions from home sellers, covering key topics like commissions, appraisals, and inspections. Commissions Q: How much do I pay in real

Read More

Categories

Recent Posts